200K Jobs Will Keep Us In A Range Until the FOMC – Sell Bull Put Spreads

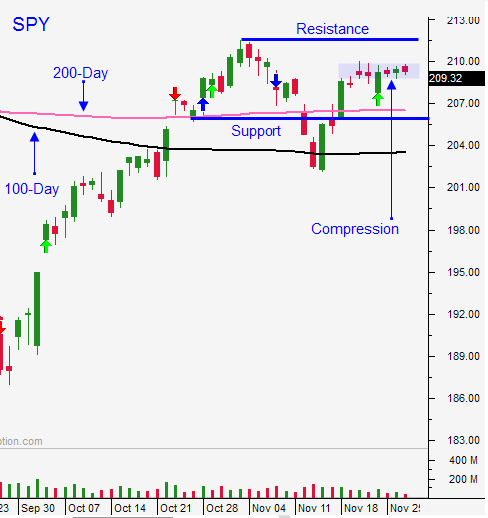

Posted 11:30 AM ET - Yesterday the market sold off and today it recovered those losses. The price action is very choppy and this is nothing but "noise". We can expect similar until the FOMC on December 16th.

China's PMI came in a little light, but nothing to worry about. Some analysts are saying that we might see additional easing. The Yuan was approved as a reserve currency by the IMF and I believe this is market friendly for China.

ISM manufacturing came in below 50 and that was a weak reading. Manufacturing only accounts for 20% of economic activity and ISM services will be much more important. I'm expecting a good number this Thursday.

ADP will be released tomorrow and analysts are expecting 185,000 new jobs. That would be consistent with 200,000 new jobs when we get the Unemployment Report Friday. Anything close to this number would cement a December rate hike.

The market is prepared for lift-off and let's hope the Fed delivers. This means that good news is good news and bad news is bad news. If the jobs number Friday is below 150,000, the market will decline. If the number is above 250,000, we will challenge the all-time high. If the jobs report is in line (200,000) the market will chop around until the FOMC meeting.

The last scenario is likely and I am selling out of the money bullish put spreads. This strategy takes advantage of time decay. Asset Managers are under-allocated and they have been reluctant to buy this rally. That means the bid should remain strong into year-end and the 200-day moving average will hold until the FOMC.

If the market pulls back before the Fed statement, I will get more aggressive with my longs. I believe they will soften the blow with "one and done" rhetoric and the market will rally into year end.

I am day trading based on the one hour range. If we are above it, I am trading from the long side. If we are below it, I am trading from the short side. If we are inside the range, I am sidelined.

Trading volume should pick up the rest of the week.

Look for choppy price action with little or no follow-through. This is a low probability environment. Keep your size small and sell bullish put spreads.

.

.

Daily Bulletin Continues...