ADP Report Cements A Rate Hike In 2 Weeks – Get Ready For FOMC Breakout

WE ARE MAKING A TON OF MONEY IN THE CHAT ROOM. TAKE THE 1 WEEK FREE TRIAL

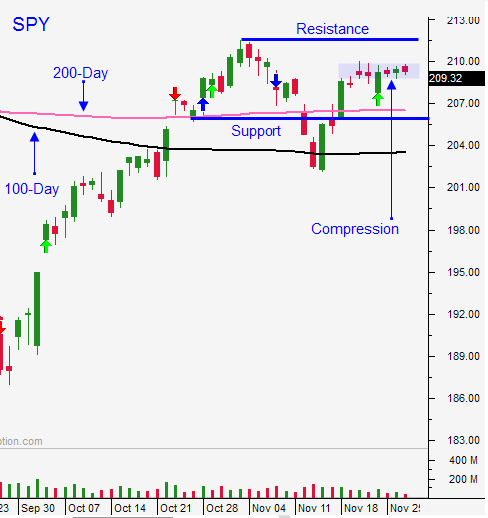

Posted 9:45 am ET - Stocks were able to overcome a dismal ISM manufacturing number and a light PMI in China on Tuesday. The market bid is strong and Asset Managers have been reluctant to buy this rally. That means some are under-allocated and anxious to add. The dips will be shallow and brief the next two weeks and the 200-Day MA will hold if tested.

ADP reported that 217,000 new jobs were added to the private sector in November. This is a very strong number and we learned that 14,000 jobs were added to the October report. ADP processes payrolls for small and medium-size businesses. I trust their number much more than I do The Bureau of Labor Statistics. We will get that number on Friday and we should easily surpass 200,000.

The ADP report cements a rate hike in December. The market has demonstrated that it is ready for the move. Strong economic releases and a "one and done" statement from the Fed would fuel a market breakout into year end.

Don't get too excited. We still have to get through the next two weeks of trading and the price action will be choppy with an upward bias. I will be selling out of the money put credit spreads (bullish put spreads) on strong stocks. Time decay will work in my favor.

If we get any meaningful declines, I will purchase calls.

The Beige Book will be released this afternoon and it will reflect sluggish but stable growth. ISM services will be posted tomorrow and the results should be good.

The volume will return today and I am favoring the upside. Good news is good news and ADP should attract buyers.

I am distancing myself from the action by selling out of the money put options and I am keeping my overnight risk low by day trading. I still consider this a low probability trading environment and we are likely to see lots of little moves without any follow-through.

Stick to these strategies until the FOMC statement on December 16th.

.

.

Daily Bulletin Continues...