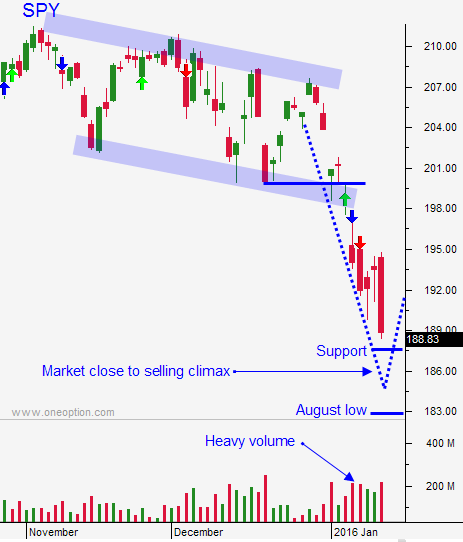

Market Is Close To A Selling Climax – Be Patient and Wait For the Pattern

Posted 9:30 AM ET - Yesterday the market easily breached support levels and the selling was persistent. When you don't see an uptick for a couple of hours, you know the pressure is heavy. The next support level is SPY $187.50. SPY $182 is the low from August and it should hold.

When the "baby gets thrown out with the bathwater", the market is close to a meaningful low. FANGs stocks were hit hard yesterday and they do not rely on China for revenues. Hedge funds that needed to raise cash sold everything and that included FANGs.

Speaking of China, their market has been up three days in a row. Their trade numbers were excellent yesterday and they hit their highest level in a year. I thought this would attract buyers ahead of earnings season.

JP Morgan posted solid results and the stock is up this morning. Intel will post after the close.

Monday and Tuesday we saw late day buying. That bullish sign was quickly forgotten once we broke support yesterday.

I make money from the long side all morning. Then I made a critical mistake. When the market broke support, I did not hedge by shorting S&P futures as I had earlier in the week. That mistake cost me and I took losses on my longs. I will spend the next two days recovering.

Even though I had a losing day, it was not a disaster. As I outlined in my comments yesterday, I won't increase my size until I see us take out the first hour high. We haven't seen that yet this year.

The pattern that has repeated itself each day is likely to surface this morning. The market opens in positive territory and then it fades.

If the market goes into negative territory, I will short the S&P futures. I will keep a tight stop and I will not short individual stocks. We are close to a reversal and I don't want to be scattered across a number of short positions. When the reversal comes, I want to be able to quickly cover my S&P short and I want to buy strong stocks.

Option expiration is Friday could produce wild swings.

The market could hit that selling climax any day. Watch for a swift decline and an immediate reversal that produces a "V" pattern on a five-minute chart. If the market continues to rally into the close we will have the capitulation low we have been looking for. Buy stocks and hold overnight if we close on the high of the day.

Don't buy until you see this pattern. There could be more carnage and you don't want to be early.

If the market rallies today and it never looks back, you will also have that “V” pattern on a 5 minute chart. I am not counting on that happening, but you need to be aware of it.

I still believe we will get an earnings bounce that will last a few weeks. When that rally stalls, we will gradually scale into short positions.

.

.

Daily Bulletin Continues...