Market On Support But Very Nervous – Stick To Day Trading For Now

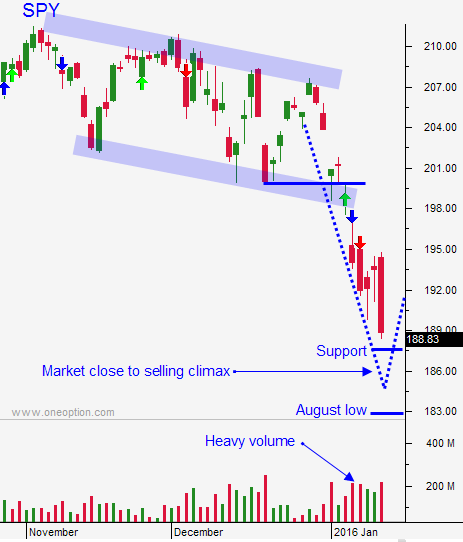

Posted 9:50 AM ET - Yesterday the market probed for support just as it has done every other day this year. The selling ran its course very quickly and we bounce off of major support at SPY $187.60. Buyers stepped in and shorts ran for cover. This is the pattern I was looking for and I recognized it instantly. I mentioned in yesterday's comments that a rally above the one hour high was needed to get long.

These capitulation lows have produced follow-through buying during the last year. We bought S&P futures and stocks in the chat room and we had a banner day.

I have very small overnight risk. I bought some out of the money January SPY calls that I held overnight ($.20) and some out of the money Google January 725 calls ($.80). These were low probability/low risk/high potential reward trades. One good day trade will offset these losses.

Yesterday I bought the S&P futures very early in the day and I bought them in size. I made 20 points day trading and apart from the two positions I mentioned, I am flat.

I did not expect a huge overnight decline. The selling late in the day yesterday did catch my eye, but not enough to suspect danger today.

China's trade numbers were strong last week and their market has rallied 3 straight days. Our market tested support and it looked like we had a capitulation. Buyers should be relatively engaged ahead of earning season and J.P. Morgan/Intel posted good numbers. We had all the ingredients for a nice bounce, but the selling pressure this morning raises serious doubt.

Oil has dropped below $30 a barrel. This is weighing on the market.

Investors have seen enough and many might be liquidating. Funds are anticipating the redemptions and they are net sellers. Hedge funds are adjusting risk and the selling pressure is heavy.

Day trading has worked well and that will be the focus today.

I will not short into this deep decline. I will watch the price action the first hour and I will use that range as my indicator. If we are above the first hour high I will focus on longs. If we are below the first hour low, I will day trade the S&P 500 from the short side.

The SPY will easily breach $187.50 and next support is at $182. That is the low from August.

Let the early price action play out and use the one hour range as your guide. If you trade from the short side, know that snapback rally is very possible in this deeply oversold environment. You need to be very nimble and you need to set targets. If we get a decent bounce this morning and the market continues to grind higher, you can ride your longs. You don't have to be as nimble trading from the long side.

On a longer-term basis, this price action is extremely bearish. Earnings season should produce a bounce, but that might run its course very quickly.

.

.

Daily Bulletin Continues...