Market Poised To Rally – If You See This Pattern – Get Long

Do you trade everyday? GET ALL OF MY RESEARCH FREE

Posted 9:30 AM ET - Yesterday the market opened strong and the early gains evaporated. It took the whole day to establish support and we rallied late in the day. We've seen this pattern two days in a row and it is bullish. With each passing day I expect the bid to strengthen.

China's trade numbers were excellent. Exports increased 2.2% and that was the first gain since February 2015. This will boost confidence and their market should stabilize.

Earnings season is upon us and Asset Managers like to buy stocks ahead of the number. Valuations are attractive at this level and options expiration has the potential to fuel a short covering rally.

The downside will be tested early. We want this move to be very brief and shallow. If the market rebounds quickly and it makes a new high for the day we can buy with confidence. If we make a new high for the day after the first hour of trading, we can increase our size. If the market closes near the high of the day we can hold some positions overnight.

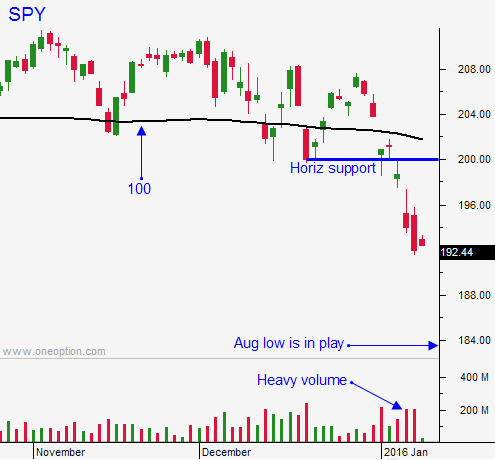

The SPY should easily reach $200 in the next couple of weeks. As it approaches the 100-Day MA we have to be more cautious.

Earnings season is "front-loaded" and the strongest companies announce early. Facebook, Amazon, Netflix and Google will be unaffected by what is happening in China and they will post strong numbers.

Typically, I would sell out of the money bullish put spreads. However, option premiums will remain elevated into earnings announcements and I do NOT want to hold over the number. I want to take advantage of declining option implied volatilities so I will short the VIX/VXX. I will also day trade aggressively from the long side when the rally unfolds.

You can also sell bullish put spreads on the SPY.

Option premiums are rich and it is not optimal to buy calls. Furthermore, the market is nervous and I don't like having a lot of overnight risk exposure.

In the initial stages of this bounce, it is okay to hold some overnights. We have plenty of upside and we should see a few days of follow-through buying. Once the momentum stalls, we need to stick to day trading.

On a longer-term basis, we need to be ready to sell calls and buy puts. The market appears to be rolling over and we could see weakness in the back half of earnings season.

We should have smooth sailing from the long side for a few weeks.

If the market continues to drift lower this morning and it takes hours to find support, keep your size small and wait for the pattern I describe above. If the dip is brief and shallow, get long.

If you own put options, take profits now.

.

.

Daily Bulletin Continues...