Sell Out of the Money Option Spreads – Day Trade Based On the First Hour Range

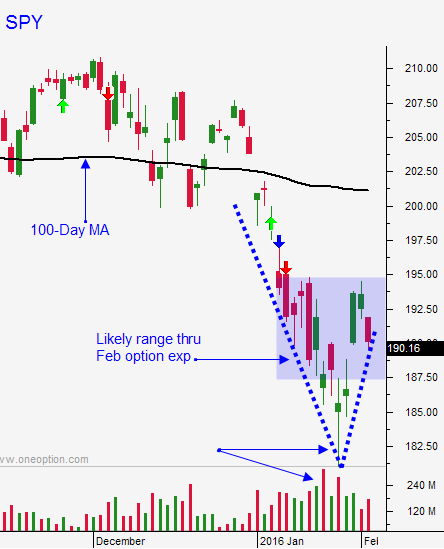

Posted 9:30 AM ET - The market is extremely volatile and much of that can be attributed to currency fluctuations. Stocks were poised for a nice open Wednesday and the bottom fell out in the first hour. The SPY broke technical support at $187.50 with ease and it looked like we might hit an air pocket. Later in the day, buyers stepped in and we witnessed a massive short covering rally that almost pushed us above $191.50. We can expect more of the same volatility today.

Option premiums are rich and I favor selling out of the money bullish put spreads over bearish call spreads by a ratio of 3:1. I am selling more put spreads because stocks are compressed and we know there is major support at $187.50. If that level fails, we know there are buyers at $182. I believe that oil is close to bottoming and I am particularly interested in selling put credit spreads on oil services stocks. These companies will be the first the benefit from higher oil prices. I don't need a spike in oil, I just need oil to stop going down and these positions will make great money.

I still believe that the SPY will maintain a range between $187.50 and $195 through February options expiration.

The second prong of my approach is to day trade. I am using the first hour trading range as my guide and I'm also aware of key technical support levels.

If the market is below the first hour range, I short S&P futures. I am not shorting individual stocks and let me explain why.

Many stocks are very compressed and they are ready to release from deeply oversold conditions. They have to be monitored very closely and at any moment a large buyer can create an instant pop in the stock. If I am short eight or more stocks during the day and the market rallies, I will be scrambling to try and cover my positions. Yesterday was a classic example. I was short one stock and it jumped $1 during the reversal before I could react. I was also short futures and with one click I covered my position and took my lumps.

Fortunately, I was short futures when the market went negative in the morning and I had an excellent day.

When I day trade from the long side, I like buying stocks. In particular, I like those that have formed a solid base and that are breaking through horizontal resistance on a buy signal. That pattern is extremely strong and these stocks have relative strength. I also know that the downside risk is contained because major support is close by. If I get caught on the wrong side of the market, I can always short some futures to hedge my positions. When the selling passes, I lift my hedge and the stocks take off. Usually, I don't have to hedge intraday. In some cases, I have taken overnight positions in these stocks if the price action is particularly strong. Although limited in use, that tactic has worked well in most cases.

Look for another volatile day. If by chance the SPY closes below $187.50, we need to take on a bearish posture. Most of my bullish put spreads are making money and they are in good shape. If the market breaks technical support, I will start buying some of my bullish put spreads back to reduce risk. I feel that I can control my risk intraday so I don't want to hedge my positions overnight. The smartest way for me to prevent a big loss is to gradually buy back my bullish put spreads if the market breaches major technical support.

Let's recap. I still believe that the SPY will maintain a range between $187.50 and $195. I am favoring bullish put spreads over bearish call spreads. On an intraday basis I am using the first hour range as my guide. If we are below the first hour low, I am shorting S&P futures. If we are above the high, I am buying strong stocks.

Look for a very choppy day today and see if you can sell some bullish put spreads in the oil services group.

.

.

Daily Bulletin Continues...