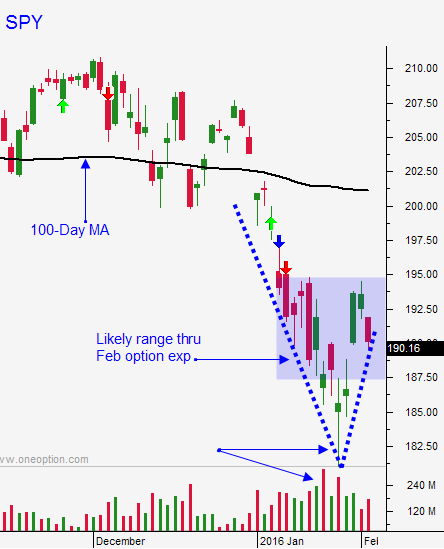

Weak Jobs Will Weigh On the Market – Bid Will Be Tested – $187.50 Needs To Hold

WATCH OUR TRADES LIVE - 1 WEEK FREE TRIAL

Posted 9:50 AM ET - This morning we learned that 151,000 new jobs were created in January. That was below expectations (200K) and the market is shouldering the news. The Fed will not hike before June and this will attract some buyers.

Two days ago we saw buyers step in when the SPY $187.50 level was tested. There was follow-through buying yesterday and we want to see strong support if those levels are tested again. I believe we will see some selling pressure this morning.

I was expecting a decent number around 200K and this weak number has me on guard. I will hedge my bullish put spreads by shorting the S&P futures if we are trading below the first hour low. I will use that as my stop and I will lift my hedge if we are above it. If the market continues to drift lower today, I will start buying back my bullish put spreads to reduce risk.

If the market treads water today, I would consider that a victory for the Bulls. That would almost guarantee that $187.50 will hold through February options expiration. I will keep my bullish put spreads on if that happens and I will day trade from the long side.

Stocks are very compressed and I am making a lot more money buying stocks intraday that I am shorting them. I have outlined my trading strategy in detail this week, please read prior comments for more information.

There will not be any significant economic releases during the next two weeks and the market should settle down. As we get to the back half of February, weak data will weigh on the market and I am likely to take on a more bearish bias.

I have enough bullish put spreads on and I will not be adding. Now I am just managing risk. Most of my spreads are safely out of harm's way and they are in good shape. I have also been selling out of the money call spreads on weak stocks. Option premiums are rich and this is my favorite options trading strategy at the moment.

The downside will be tested this morning and this will give us a chance to see how strong the bid is.

Use the first hour range as your guide. If we continue to drift lower throughout the day, buy back some of your bullish put spreads and reduce risk. I do not plan to hedge over the weekend. I believe I can control my risk intraday.

If by chance the market closes below $187.50, I will buy back my put spreads and shift to a bearish bias.

.

.

Daily Bulletin Continues...