Market Range Bound Thru Feb Options Expiration – Sell OTM Option Spreads

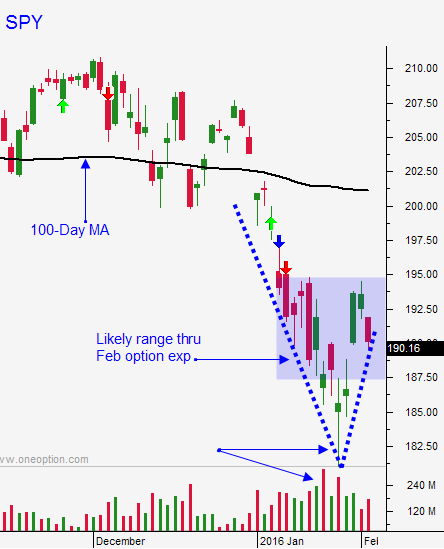

Posted 9:40 AM ET - Yesterday the market dropped below a minor support at SPY $191.50. All of the constructive price action we've seen in the last few days was wiped out. In order to reach SPY $200, we needed to make progress this week. The selling pressure tells me that we might not get through SPY $195.

The market had all of the good news it needed to rally. The strongest companies posted good earnings and central banks (PBOC and BOJ) have been easing. Additionally, the FOMC statement was dovish and the Fed is not likely to raise rates before June.

This morning, ADP reported that 205,000 new jobs were added to the private sector in January. This was a good number. Friday's jobs report should come in around 200K. ISM services will be released 30 min. after the open and it should be solid. Unfortunately, economic releases are not attracting buyers.

I still like selling out of the money bullish put spreads in February. This options trading strategy takes advantage of high option implied volatilities and time decay. I still believe that support at SPY $187.50 will hold through February options expiration. Given the choppy market conditions, I know that I might have to hedge intraday by shorting the S&P futures. I outlined this strategy yesterday.

The drop Monday tells me that resistance is stiff. I believe that SPY $195 will also hold through February options expiration. I sold a few out of the money bearish call spreads yesterday. I am a less aggressive with this option trading strategy relative to selling bullish put spreads.

The market looks good this morning, but I suspect we will probe for support. Ideally, we will find it early and the SPY will close above $191.50 today. If that happens the trading range will start to form ($187 - $195).

Look for opportunities to sell option premium. Identify strong stocks with technical support and sell bullish put spreads below support. Find weak stocks with technical resistance and sell call spreads above that resistance level.

From a day trading standpoint, I take my lead from the first hour range. If we are above it, I look for strong stocks to day trade. If we are below it, I short the S&P futures. I'm a little more cautious shorting this market and I don't like to be spread out across many different stocks. In general, stocks are oversold. They have to be monitored closely because they can bounce at any moment. The futures are easier to get in and out of.

On the long side, stocks are compressed they are ready to release. If the market is flat, they grind higher. When the market rallies, they release. I like buying stocks that have formed a solid base and that are breaking through horizontal resistance. They have lots of room to run and the downside is contained.

Swing traders should look for opportunities to sell out of the money call and put options.

Day traders should sell option premium and day trade based on the first hour range.

.

.

Daily Bulletin Continues...