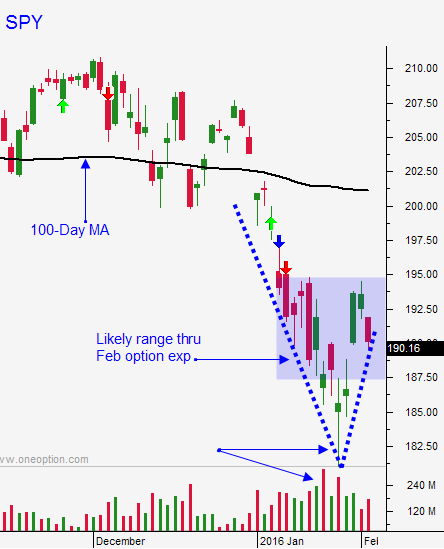

Market Breaks Major Support – SPY $182 Will Be Tested

WATCH OUR TRADES LIVE - 1 WEEK FREE TRIAL

Posted 9:30 AM ET - Last week the market challenged major support at SPY $187.50 a number of times and it held. This morning we will fall right through it and we are likely to test SPY $182 sometime this week. Earnings season temporarily stopped the bleeding and the strongest companies were not able to spark buying after they posted.

Domestic economic releases have been strong relative to the rest of the world. Last week we saw some kinks in the armor. ISM services fell to 53 and that was the lowest reading in many months. Friday's jobs report came in at 151,000 and that was far below expectations.

The FOMC statement warned that conditions might be deteriorating. The silver lining is that the Fed will not hike rates before June.

Central banks have been easing like mad and Japan pushed its yields into negative territory. The PBOC has been injecting massive amounts of liquidity. Some of that might be related to the Chinese New Year. Their market will be closed this week.

The back half of earnings season will begin and the results will be soft. Retailers will start posting in a couple of weeks and I am expecting dismal numbers.

Last Friday I started to buy back my bullish put spreads. Overall, I was able to lock in small gains. Time decay was already starting to kick in and my stocks held up well. This morning I will buy the rest of my bullish put spreads back even if the stocks are above technical support. The market has breached a key support level and I want to reduce risk. I did not hedge overnight and I don't plan to.

I am short a few call spreads and that will help offset any losses from my bullish put spreads this morning.

This is been a time to distance yourself from the action by selling out of the money option premium. This strategy was starting to produce nice results. Unfortunately, the market was not able to hold major support and it's time to close those trades.

I will short futures if the market makes a new low after 30 minutes of trading. Per my comments last week, I don't want to spread myself across a lot of stocks when shorting. I want to be able to move in and out quickly.

These big moves lower on the open have provided day trading opportunities from the long side. Stocks are incredibly compressed and many of them have formed solid bases. I'm looking for horizontal breakouts through resistance during these negative opens. Once the market finds support, these stocks fly higher. This strategy might sound counterintuitive, but we've been making fantastic money with this strategy all year. Take the free trial and watch us in the chat room.

The news is light this week and the downward momentum is set. Asset Managers will not stand in the way and we are likely to hit an air pocket.

The market has crowned and we are making lower highs. Support at SPY $182 might hold for a few days, but eventually it will fail.

I will look for opportunities to sell out of the money call spreads on any rally.

I will be very focused on day trading this week. This strategy gives me maximum flexibility in a turbulent market. Option implied volatilities are extremely high and I don't like buying put options unless I can find stocks that typically trade with low IVs.

Watch for selling this week. Buy back bullish put spreads and sell bearish call spreads. Use SPY $187.50 as your stop.

.

.

Daily Bulletin Continues...