Market Is Tired and Resistance At SPY $195 Held – Sell Bearish Call Spreads

1 WEEK FREE TRIAL - SEE WHAT WE ARE TRADING IN THE CHAT ROOM

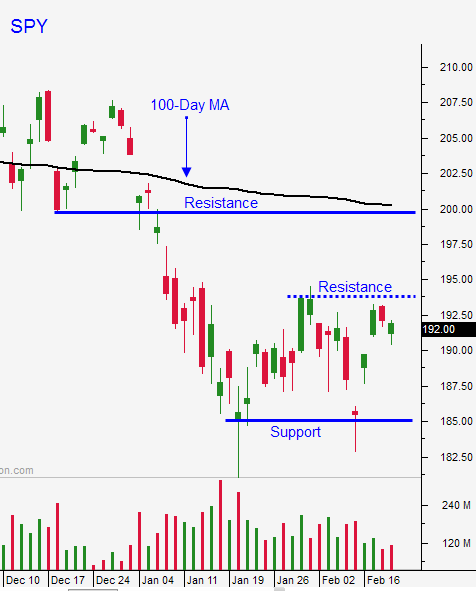

Posted 9:30 AM ET - Yesterday the market drifted lower throughout the day and it closed on its low. The PBOC/BOJ bounce has run its course and resistance at SPY $195 is holding. The news is fairly light this week and now that the downward momentum has been established, we are seeing follow-through selling this morning.

Minor support at SPY $191.50 will be breached. Major support is at SPY $187.50.

We have the signs of exhaustion that I've been looking for and I will sell some out of the money bearish call spreads (a.k.a. call credit spreads). This options trading strategy takes advantage of time decay and I can distance myself from the action. Energy, basic materials, retail, banking and heavy equipment stocks will be ready to roll over. They have bounced from deeply oversold conditions and the macro backdrop remains bearish.

If the selling accelerates after an hour of trading, I will buy some puts. I want to temper my bearishness in this light volume environment.

Ironically, my best day trading days have been on gaps lower this year. I line up strong stocks that are breaking through horizontal resistance. They stick out like a sore thumb and I wait for market support. When the market bounces, these stocks take off.

Take your cue from the first hour of trading. If we are below the low, favor the short side. If we are above the high, trade from the long side.

I did sell some bullish put spreads last week and I will be closely monitoring them today. As long as the stocks state above technical support, I will maintain the position. However, if the market continues to slip the entire day, I will exit the trades. I don't want to get caught on the wrong side of a market decline.

I still believe the next big move will be down. If we break SPY $187.50 I will buy puts.

My trades today will be more balanced. I have been favoring the long side and I will be looking for opportunities on both sides.

Phase 1 for shorting this market is to sell out of the money bearish call spreads when we see signs of exhaustion. If we finish lower today, we will know that resistance at SPY $195 is likely to hold through March options expiration.

Phase 2 will be to buy puts and we need to see sustained selling. That could happen today or it might take a couple of weeks. We don't want to be early. Use $187.50 as your guide.

We will be busy in the chat room today. If you want the play-by-play and lots of great trades, take the one-week free trial.

.

.

Daily Bulletin Continues...