Early Rally Will Stall – China Was Down 6% and Resistance At $195 Will Hold

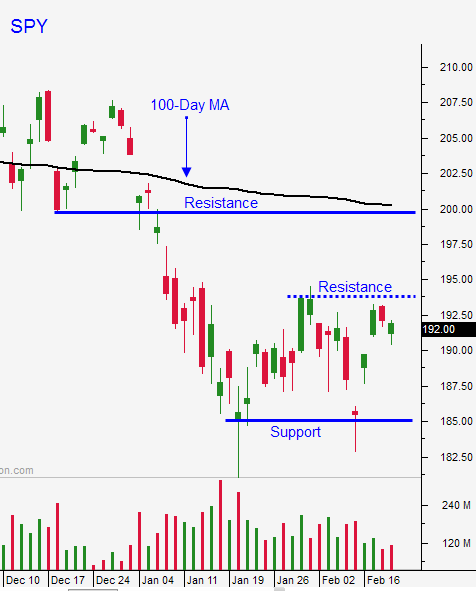

Posted 9:30 AM ET - The market has been on a roller coaster ride this week. Stocks gapped lower yesterday and they instantly found support. We saw an impressive reversal and the market finished on the high of the day. There is a little follow-through buying this morning, but resistance at SPY $195 will hold this week.

We are in a news vacuum and trading volumes are low. I would not read too much into the decline or the reversal this week.

There is an underlying bid to the market and that is encouraging. Cyclical stocks are fragile and at the first sign of trouble they rolled over this week. When the market is ready to selloff, these will be excellent put candidates. Financials also look weak.

This is the time to look for relative weakness and the decline this week gave you an opportunity to identify it.

In my comments yesterday I told you that I would be selling call spreads and buying puts if the market made a new intraday low after two hours of trading. That didn't happen and by mid-day it was apparent that a strong reversal was underway. I also mentioned using the first hour range as your guide. If you got long when the SPY broke through the high, you had an excellent day.

I am seeing opportunities on both sides of the market. Yesterday I only had two bullish trades in the chat room and I had 16 winners and 1 loser. Most of the traders in the chat room wisely focused on the long side and they were posting great results (12 winners and 1 loser). My point is that you can trade from both sides of the market as long as you have a systematic approach. We only trade one pattern. If all of the elements are in place, our probability of success is extremely high.

Yesterday I did close out a couple bullish put spreads for small losses. I still left many of them on and they are in good shape. Given the wild swings this week, I'm not looking to sell many credit spreads unless we get to $195. I will focus on day trading.

China's market was down 6% overnight. They will post official PMI's next week and they will be very important. China is one of the primary market concerns.

We will see a little follow-through buying on the open this morning and there will be an opportunity to get long. Make sure to take profits quickly because this rally is likely to stall. Resistance at SPY $195 is firm and buyers will be passive after a big decline in China. I believe the rally will stall and we could test the downside.

After an hour of trading, make sure you are not overloaded on the long side.

I was very comfortable shorting yesterday and I will look for opportunities once the rally stalls. My day trading will be fairly balanced and I will look for longs and shorts that fit our pattern.

As always, use the first hour range as your guide. If we are above the high, trade from the long side. If we are below the low, trade from the short side.

Support is at SPY $191.50 and resistance is at $195.

.

.

Daily Bulletin Continues...