Day Trade Stocks With Relative Strength Today – Hit and Run

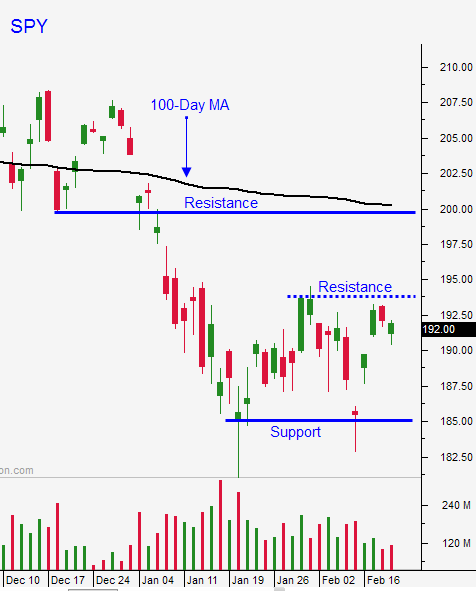

Posted 9:30 AM ET - Yesterday the market challenged horizontal resistance at SPY $195. It was able to hold the gains throughout the day and that demonstrates a solid bid. We are in a news vacuum and daily ranges are compressed. Trim your size.

My preferred swing trading strategy is to sell bullish put spreads. This options trading strategy allows me to distance myself from the action and I can take advantage of elevated implied volatilities and accelerated time decay. Two weeks ago I started selling February bullish put spreads and they expired last Friday (max profit). Over the last few days I've also in selling March put spreads.

Central banks are printing money like mad and that is keeping buyers engaged. Economic data has been soft, but investors are willing to look past that as long as the Fed postpones future rate hikes. They are not likely to raise rates before June.

If the market rallies above SPY $195, I will start selling out of the money bearish call spreads on cyclical stocks that have bounced. Global economic conditions are deteriorating and these stocks will be the first to roll over once the market rally stalls. I will be watching these stocks very closely and if they can't rally with the market, I will know that they are close to topping out.

I still like day trading from the long side and I love trading when the market opens lower. Strong stocks stick out like a sore thumb and I watch for relative strength on a five-minute chart. When the market finds support I buy the stocks and watch them run.

I mentioned earlier that the intraday trading ranges are very tight. I am trading smaller size and I am setting targets. When you get the move you have to be ready to take profits. We will be in this hit and run environment the rest of the week.

Look for quiet trading with an upward bias. If the market can get through $195 this week it could make a run at $200 next week. There is small support at $191.50.

.

.

Daily Bulletin Continues...