Early Rally Is An Easy Short – Speedbump Ahead – Sell Calls and Buy Puts

1 WEEK FREE TRIAL - SEE US MAKE MONEY IN THE CHAT ROOM

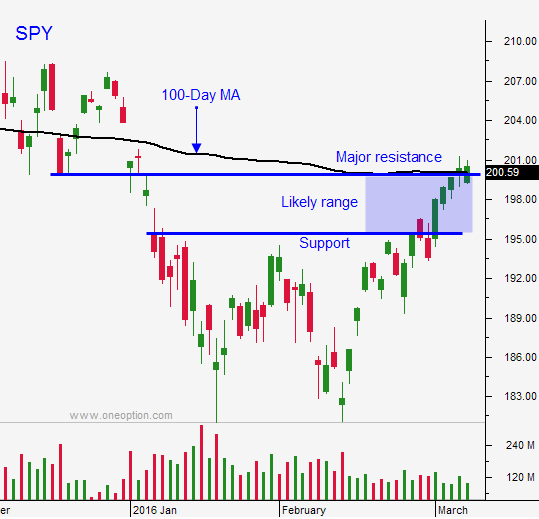

Posted 9:30 AM ET - Yesterday the market chopped around most of the day and it tried to recover from early losses. An hour before the close we saw steady selling and the SPY closed on its low of the day. It is below major horizontal resistance and the 100-day moving average. I believe we are set up for a pullback.

Much of the rally during the last two weeks can be attributed to short covering in commodity stocks. Consequently, emerging markets have also done well. Hedge funds were scrambling to cover short positions and this is nothing more than a bounce.

As I mentioned yesterday, without FANGs, this rally will roll over. We need strength from mega cap tech stocks if we are going to push through SPY $200 and we have not seen it. Amazon, Apple, Facebook and Netflix are all on sell signals.

The macro backdrop for cyclicals is weak. China's exports declined 25% and imports declined 14%. Their growth is slowing at a steady pace. Europe and Japan are flat lining and the US has 1% growth. There are no signs of strength.

Central banks have been printing money like mad and they are the catalyst behind this rally. Most traders believe that the ECB will cut rates by 10 to 15 basis points tomorrow. Once that happens, this sugar high will quickly run its course and the selling will resume.

It is unusual for the market to blow through major resistance on the first attempt. The SPY will pull back into the middle of the range ($195-$200). This speed bump will allow us to gauge the selling pressure.

SPY $195 should hold through March options expiration. If the bid remains strong, we will chop around in the range until Q1 earnings season. If the selling pressure is heavy, we could breach that support level and test $187.

The market is up this morning and I will be looking for shorts. Yesterday I exited all of my bullish put spreads and I locked-in profits. I also sold my overnight stock positions and the small remaining call positions I had on. I also bought puts on two stocks. If the market trades below the first hour low today, I will add to bearish positions ahead of the ECB.

From a day trading standpoint, I will be more balanced. I have been trading from the long side primarily and now I will look for longs and shorts. I will use the first hour range as my guide.

The opening rally this morning seems like an easy fade and I will trade from the short side early.

I have been very careful not to prematurely short the market. I am seeing signs of weakness and I am gradually taking bearish positions. I know that I might take some heat and that I am a little early.

A pattern of late day selling would be bearish.

Use SPY $200 as your guide for swing trades and use the one hour range as your guide for day trades. I want to sell bearish call spreads on cyclicals where the IVs are high. I will also buy puts on stocks where IVs are < 35. Option implied volatilities have declined and we can finally buy premium.

Exit bullish positions and ease in to bearish positions.

.

.

Daily Bulletin Continues...