Don’t Buy This Market Breakout – Wait and See – It Could Be A Great Short!!

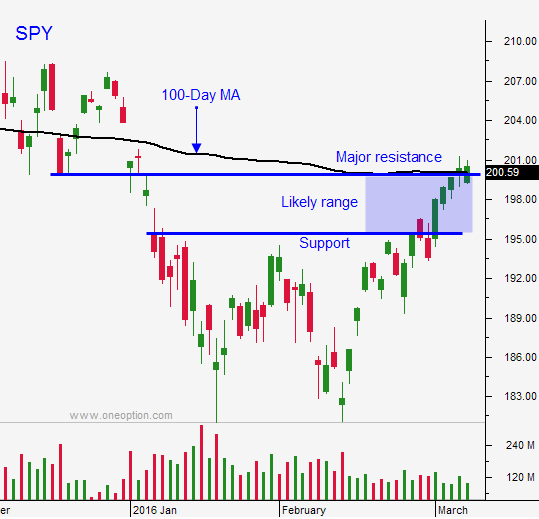

Posted 9:30 AM ET - The market has been resilient this week and it has been able to tread water below major resistance at SPY $200. That is the 100-day moving average and it is a significant horizontal level as well. As expected, the ECB cut rates by 10 basis points and the market loved the news. The S&P futures rallied 18 points after the announcement.

The S&P 500 is above the 100-day moving average and horizontal resistance. It is challenging the high from last week and we will see if it holds. The 200-day moving average is 10 only points higher and it will provide a stiff headwind.

Some of you might be laughing that I got this call wrong. I knew I was early and I knew that I might take some heat on my short positions. I am short a few stocks and I bought April puts on a few stocks. My bias is bearish, but my exposure is relatively small. Today I will be looking for stocks that do not participate in this leg of the rally. If they are showing signs of weakness and there is overhead resistance, I will look for opportunities to get short.

I will also be looking for day trades on the short side early in the trading day.

You might be scratching your head wondering why I would fade a breakout above resistance when the news is bullish. I feel that this surge could be a head fake. It will lure bullish speculators in and the door will get slammed in their face.

I've seen many FOMC reactions where a rate cut led to an initial rally and an instant reversal. Traders have very short memories. They won't even relish this rate cut and they will be looking for the next one. The ECB's move was widely anticipated and that is one reason the market has been able to tread water the last week. Now that the news is out, sellers will be more aggressive.

Global macro conditions are VERY fragile and the ECB did not cut because activity is robust. They cut because they are trying to stop the bleeding. Unfortunately, this rate cut will not stimulate economic growth.

From a swing trading perspective, I will not sell bullish put spreads until the SPY can stay above $200 for a week. That puts us past the FOMC statement and March options expiration. On the other hand, if SPY $200 fails I will not hesitate to sell bearish call spreads. This will be the second time that support has failed and the selling pressure will increase as resistance builds.

After the first hour of trading, I will use that range as my guide for day trades. If the market is above the first hour high I will trade from the long side. If the market is below the first hour low, I will trade from the short side.

I want to short this market and I have been very patient. I think I might get an excellent opportunity today and if $200 fails, I will be fairly aggressive.

The S&P 500 has declined 10 points from its high since I started writing my comments. If this early rally fails, we will see a nasty round of selling.

Use SPY $200 as your guide. If we are below it today, sell bearish call spreads and buy puts. Use the first hour range as your guide for day trades. If the market grinds higher, passively day trade from the long side and know that the 200-Day MA is close.

.

.

Daily Bulletin Continues...