Market Rally Has No Bite Without FANGs – Speedbump Ahead – Take Profits On Longs

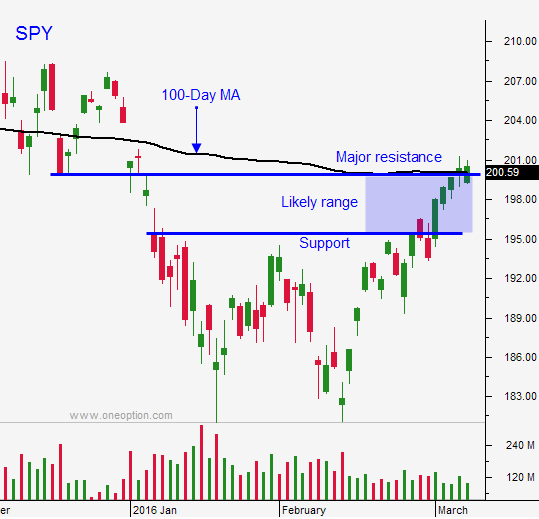

Posted 9:30 AM ET - Last week the market rallied through major resistance at SPY $200. It is unusual to get through levels like this on the first attempt and we are likely to hit a speed bump this week.

China's trade numbers were horrible. Exports were down 25% and imports were down 14%. Thursday morning they will post retail sales and industrial production. These numbers will be soft, but better than feared.

Given these dismal results, it's hard to justify the strength in commodity stocks. I believe hedge funds were scrambling to cover short positions. These stocks will present an excellent shorting opportunity.

Thursday morning the ECB is expected to cut rates by 10 to 15 basis points. This sugar high will instantly run its course and this could be a "sell the news event".

It is still too early to aggressively short this market bounce. Yesterday we saw late day selling and buyers stepped in and pushed the SPY back above $200. Japan was in a nasty decline this morning and a strong bond auction sparked a sharp reversal. There is a bid to this market and it will take a little time to soften it.

If a rally above SPY $200 was in the cards, we needed to see a rotation out of commodity stocks and into FANGs. Amazon, Apple, Facebook and Netflix are all on sell signals and they all rolled over yesterday.

I have been tempering my bearish bias and I am ready to dip my toe in the water.

Today I will take a more balanced approach. If the market is below SPY $200, I will sell some out of the money bearish call spreads.

This year we have been buying bullish stocks when the market opens lower. That strategy will still work, but we have to be patient. Now that the market has rallied to resistance, it has greater downside. These early dips might turn into a sustained decline. Consequently, I will be looking for more shorting opportunities and I will shift away from this strategy.

When the market was down at the SPY $187 level we were able to hold failed bullish day trades overnight. The pattern we trade is extremely strong and in almost every case, these stocks rebounded and we were able to make money on the trades. I don't believe will have this luxury any longer. We have to take our lumps on failed bullish day trades right away. I believe the overnight risk for long positions is increasing.

Option expiration is a week away and I still believe that SPY $195 will hold. I have profitable bullish put spreads that I will buy back. Every day that I wait increases my profits. Time decay is chipping away at the premiums. If I see sustained selling I won't hesitate to reel them back in.

Let's recap. Use SPY $200 as your guide for swing trades and use the first hour range as your guide for day trades. Take a more balanced approach and start looking for shorting opportunities. Reduce overnight long exposure and take profits on bullish swing positions.

We could hit a few speed bumps Thursday morning and that would solidify resistance at SPY $200.

.

.

Daily Bulletin Continues...