Bullish Speculators Are Getting Flushed Out – Buy This Dip – Be Patient

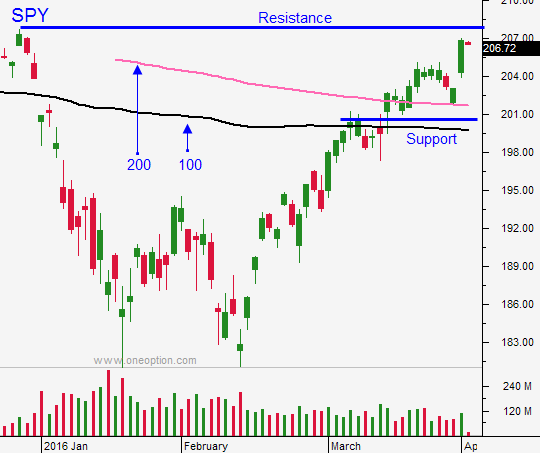

Posted 9:50 AM ET - Yesterday the market took a breather and we are seeing some follow-through selling this morning. The SPY will breach minor support at $205 and we could hit a small air pocket as bullish speculators get flushed out. I mentioned this scenario in yesterday's comments.

The overnight news was fairly benign and this round of selling is nothing more than a speed bump. Buyers will stay engaged ahead of earnings season and I believe this will set up a nice little buying opportunity. I want to stay passive and I might sell some bullish put spreads if the SPY gets down to the $203 level (I don't believe we will get that low).

If by chance my analysis is wrong and we breach $202, we won't stay below it very long. SPY $200 is major support and it will hold into earnings season.

Central banks are printing money like mad and bond yields are near historic lows. The Fed has pushed back its timetable and a rate hike before the presidential election is unlikely. This is good news for the market.

China's PMI came in above 50 for the first time in months and that is good news. Global PMI's were in line with the flash number.

We will get ISM services 30 minutes after the open. That number has been soft the last few months, but it might be flat lining. If it comes in above 53, the market will like the news.

You know from my comments that my longer-term forecast is bearish. This market rally is within striking distance of the all-time high and a move of that magnitude needs time before it tops out. We will not roll over and drop. I need to see technical damage before I start taking overnight short positions.

Bullish sentiment was too high and some of the "fluff" is being taken out today. I have kept my overnight risk exposure very low for exactly this reason.

The dip today will reveal important information. I will be looking for relative strength and rotation. I expect to see money leave cyclical stocks and I expect to see relative strength in tech. Pharmaceutical stocks and biotech did well yesterday. I hope to see some strength in Internet and in semis.

Buying overnight declines has been a very successful strategy for me this year. I will use extra caution this morning. When bullish speculators get flushed out, they hit bids. Asset Managers could pull their bids and we could hit an air pocket today. I am not looking for an early bounce - we need a selling climax and that could take a couple of hours.

I will be looking for a bounce, an attempt to retest the lows and a second bounce. This will result in a higher low and that will be a signal to trade from the long side. If the SPY rallies above $205, I will get more aggressive day trading from the long side. I believe this dip will be temporary and it will set up an excellent buying opportunity.

If the market makes a new low after one hour of trading, I won't fight the trend. I will day trade from the short side and I will favor cyclicals and basic materials.

Be patient and let the market come in. Spend your time looking for relative strength. Stocks that have broken through horizontal resistance on volume after a period of consolidation are ideal candidates. You want to see them holding their own today and when the market stops going down, you want to see a pop. I have searches that identify this pattern and I will focus my attention on these stocks.

Look for a nasty little day today that sets up a buying opportunity ahead of earnings season.

I don’t believe we will see a sustained decline for a few weeks (at earliest).

.

.

Daily Bulletin Continues...