Light News Favors Current Momentum – Gradual Grind Higher Likely This Week

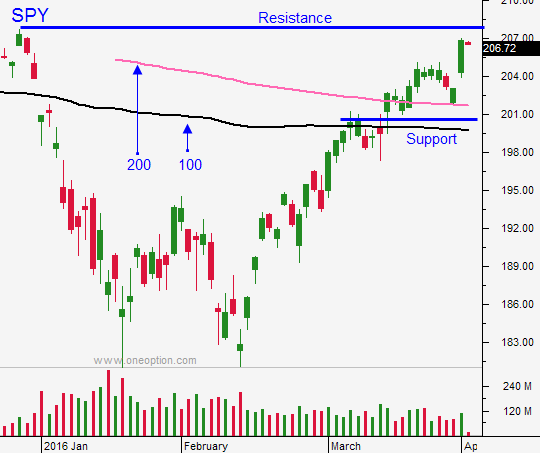

Posted 9:30 - Last week the market rallied on dovish comments from Janet Yellen and a “Goldilocks” jobs report. The news is fairly light this week and that favors the current momentum. Buyers will stay engaged ahead of earnings season and we should grind higher this week.

Last Friday we learned that 215,000 new jobs were created in March. That was good enough to suggest growth and not hot enough to prompt a rate hike in June.

Stocks tested the downside early on Friday and they instantly rebounded. As I mentioned in my comments, the news was market friendly and I suggested trading from the long side right out of the gate. If you took my advice, you had a good day.

China's PMI was bullish and it was above 50 for the first time in months. That should soothe credit fears.

ISM services will be released Tuesday and I'm expecting a decent number. On Wednesday, the FOMC minutes will be released and they should be consistent with dovish remarks from the Fed.

Many Asset Managers are under allocated and I suspect they are playing catch-up. We should see a rotation out of cyclical stocks and into tech.

I sold bullish put spreads a few weeks ago and those positions are in great shape. I own a few calls, but my exposure is small.

Call buyer's need to focus on stocks that are breaking through horizontal resistance after trading in a tight range. These breakouts tend to produce sustained moves. Know that you will not have much of a market tailwind. Also know that we are due for a nasty little day where bullish speculators get flushed out. I am primarily day trading stock.

If we get a move greater than 10 S&P points, I like fading that move in the first hour. Otherwise, I am using the first hour range as my guide. If we are above it, I trade from the long side. If we are below it, I trade from the short side.

I am seeing excellent opportunities on both sides of the market.

Look for a gradual grind higher this week and the potential for one nasty little day of selling. Also watch for a rotation into tech stocks.

Keep your overnight exposure small.

Trading volumes were very light last week and they should improve slightly this week.

.

.

Daily Bulletin Continues...