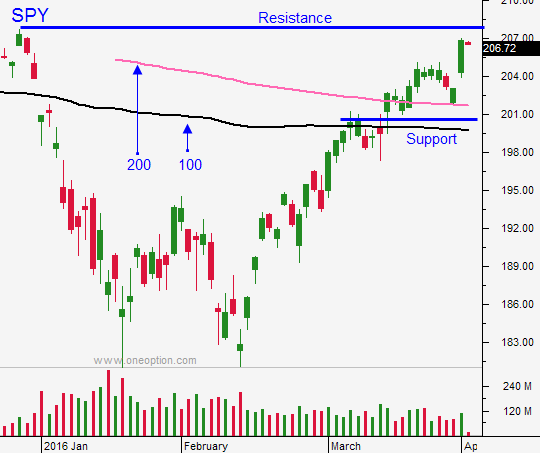

FOMC Minutes Will Be Bullish and SPY Should Close Above $205 Today

Posted 9:30 AM ET - Yesterday the market pulled back and it closed on the low of the day. Minor support at SPY was breached, but the volume was light. We should expect a little consolidation after a big run and I would not read too much into the decline.

In my comments I mentioned that we were due for a "nasty day" this week and we have it under our belt. Bullish speculators have been flushed out and some of the “fluff” has been taken out.

The S&P is trading higher before the open and stocks should bounce today. I'm expecting a rally above SPY $205. We should see a gradual grind higher this morning and the FOMC minutes this afternoon should provide a small boost.

Central banks have been printing money like mad and credit concerns have eased. The Fed has been dovish and a rate hike before the November elections is unlikely.

The economic news has been improving. Friday's jobs report was perfect (215,000). China's PMI rose above 50 for the first time in months and ISM services was better than expected yesterday.

Earnings season starts next week and that will keep buyers engaged. We are seeing some rotation into biotech and drugs. I expect to see improvement in Internet and semis soon.

Option IVs have come in and I am not adding to my bullish put spreads. I'm not properly rewarded for the risk and one small stumble could spell trouble for these positions. I will buy back my existing put spreads next week to lock in profits.

I'm not buying any calls either. Premium buyers need a market tailwind to fuel the stock and we don't have that. Most stocks are up one day and down the next. This is not the price action call buyer's need. It would take a very special situation for me to buy call options.

Trading volumes have improved and this is been a great week for day trading. I make 90% of my money in the first 3 hours of trading. TAKE THE FREE TRIAL AND WATCH US IN THE CHAT ROOM.

I will trade from the long side today and I will focus on tech stocks. If the market makes a new high after the first hour, I will trade with greater confidence and I will be inclined to let the positions run a little. If the SPY gets back above $205 we could see another nice run the rest of the week.

I feel like the market has upside, but I'm not confident enough to carry overnight positions. I feel like I can catch most of the move day trading and not have the overnight risk exposure.

.

.

Daily Bulletin Continues...