Day Traders – Buy This Dip – Biotech and Drugs Catching A Bid

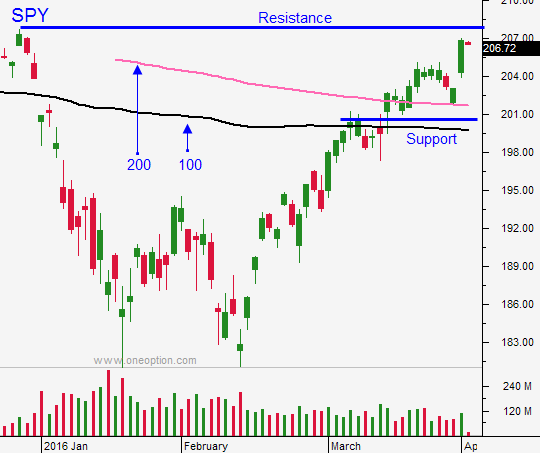

Posted 9:30 AM ET - Yesterday the market rebounded as I predicted and the FOMC minutes fueled the move. The SPY is back above $205 and that rally provided a great day trading opportunity. Some of those gains from Wednesday are being given back this morning, but support at $205 will hold. Once again, I will be buying at that level.

The vast majority of my trading has been intraday. I don't want overnight risk and I feel like I can catch the remaining upside by day trading. This dip is a classic example. I will have a chance to reload my longs this morning at better prices and I did not have overnight risk exposure.

Biotech and pharmaceuticals have been hot. I will focus on those stocks today. There is a rotation out of cyclicals and into tech. You can see that by the outperformance of the QQQ vs. SPY yesterday.

The Fed is dovish, central banks are printing money, economic releases have been good (ISM manufacturing, ISM services, jobs report and China's PMI), and earnings season begins next week. These are all bullish influences.

I am not looking for a runaway rally, but I do believe the bid is fairly strong. If the market can't get above SPY $208 next week we might start to see a topping process. That could take a few weeks to unfold, but it would set up a nice shorting opportunity in May.

I don't want to jump the gun so let’s focus on bullish stocks. The news is light and that favors the upside.

Even in a flat market, I can make money day trading rotation. Watch for groups that have relative strength. Stocks that have compressed and that are breaking through horizontal resistance are ideal candidates. Compressions are like a coiled spring and these stocks have great momentum once they breakout.

This has been an incredibly profitable week for us in the chat room. It's nice to have easy pickings from time to time.

I will wait for support and I will buy today. I don't believe we will get all the way back down to SPY $205, but that would provide an incredible entry point. The downside will be fairly limited today and buyers will step in.

Buy this dip and keep your overnight risk exposure small. Focus on day trading.

.

.

Daily Bulletin Continues...