Market At High For the Year – This Is the Final Push – It Ends With Apple

Posted 9:30 AM ET - I mentioned yesterday that the early rally would be challenged and that the ensuing price action would set the tone for the week. Stocks drifted lower and they quickly found support. News that an oil production freeze was likely attracted buyers and the SPY blew through $205. This morning we are seeing follow-through and the high of the year will be challenged.

China's trade numbers were good. I have seen hints of improvement and I suspected as much. Friday's numbers (industrial production, retail sales and GDP) should be market friendly as well. This was one of the catalysts we were looking for.

There is a slight upward bias for this option expiration cycle and that will help.

JPM is trading higher after posting earnings. Bank of America and Wells Fargo will post on Friday and financials will be lucky to tread water.

Yesterday I shorted the open as mentioned and that was very profitable. After three days of opening on the high and closing on the low, I knew that buyers would be cautious. The downside would be tested and the market would not move higher until support was established.

Once the SPY was back above $205, I quickly shifted gears and bought energy stocks.

This is the push higher than we've been looking for and this rally should last until Apple announces. The gains will be hard-fought and I will be watching for signs of exhaustion. It is way too early to short this rally. I am bearish longer-term, but I need technical confirmation.

I am starting to see some great shorts.

It is unlikely that the market will blast through on its first attempt this morning. Oil is trading lower and we don't have that catalyst. Be patient and wait for prices to settle down. Spend time identifying relative strength early in the day and start scaling in once the bid strengthens. That could happen right away or it might take an hour.

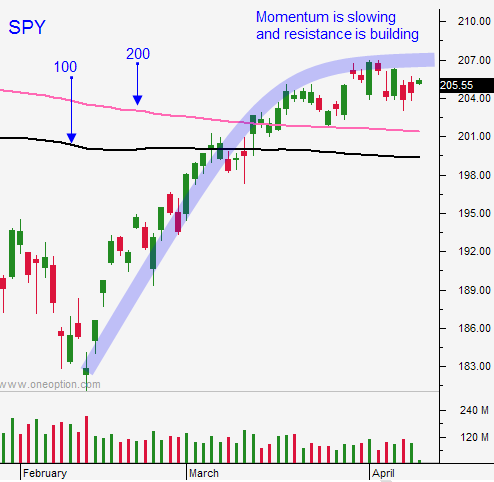

Support is at SPY $205 and resistance is at $207.

Use the first hour trading range as your guide. I believe the market will struggle to get through the high. After chopping around this morning, the bid should strengthen and we should grind higher. The gains from this point forward will be hard-fought.

The price action the next two weeks should generally be bullish, but expect speed bumps.

The gusto in this final leg of the rally will tell me how much gas is in the tank. If we spike and reverse in the next week, prepare for a decline. If we gradually move toward the all-time high, it might take a while before the market rolls over.

.

.

Daily Bulletin Continues...