Bearish Pattern – Market Will Probe For Support This Morning

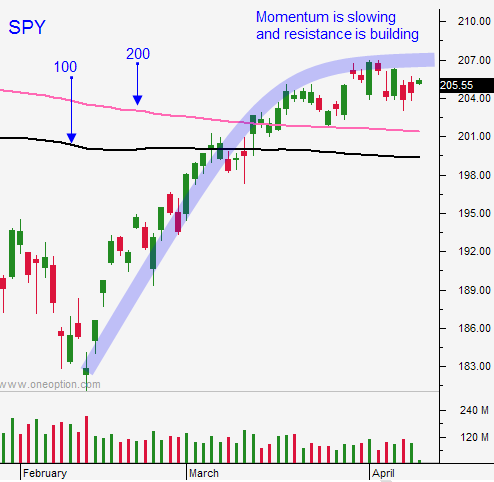

Posted 9:40 AM ET - Yesterday the market opened on its high and it closed on its low. This is the third day in a row and this has turned into a bearish pattern. The SPY is below $205 and I believe we will probe for support this morning. If the market catches a bid, we will reverse and grind higher. If not, we could take out the low from last Thursday ($203.20) and challenge $202 this week.

There was not much news overnight. The price action yesterday was lackluster and China had its slowest session of the year.

China will post trade balance numbers tomorrow and they will be fairly important. On Friday they will post industrial production, retail sales and GDP. This is the biggest news event of the week. In general, the economic news should be market friendly.

Alcoa announced earnings after the close yesterday. They lowered their sales forecast from 6% to 5% and they cited soft demand in China and North America. Banks will post results this week and I believe the reaction will be negative.

PC sales were down 9.6% year-over-year and that will be a drag on tech. We needed this sector to lead the final charge and we might not get it.

I bought back my bullish put spreads and I locked-in profits. I sold them when the SPY was still trying to get through $202. These positions were easy to manage since they were way out of the money. I just needed to wait for time decay to take its toll.

My risk exposure is low and I'm not taking any overnight positions.

I will favor the short side during the first hour of trading this morning. I feel that we won't move higher until we find a solid bid. After the first hour, I will use that range as my guide.

If by chance the market gets above $205, I will increase my size. That is a resistance level and it will attract buyers if we can get above it. If the market trades below $203.20, I will also increase my size. That was the low from last Thursday and a breach would be bearish.

I trimmed my size and I will keep it small between $203.20 and $205. This is a very choppy, directionless environment and the volume has suddenly dried up. The bid we saw last week in biotech and pharma is gone.

Regardless if the market moves or not, our trading opportunities will increase next week. Earnings will provide us with plenty of action.

Be patient.

.

.

Daily Bulletin Continues...