Market Will Finish the Week On A High Note – Day Trade From the Long Side

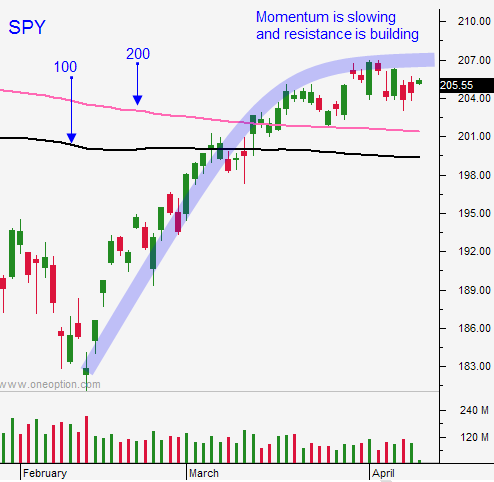

Posted 9:30 AM ET - Yesterday the market rallied to the high of the year and it was able to hold the gains. This was a positive sign since we should've seen some profit-taking at that level. Buyers were engaged and we should be able to inch higher the next couple of weeks.

Financials rallied after J.P. Morgan posted better-than-expected results and Wells Fargo is up after announcing earnings this morning. Banks could provide a little boost for this rally. Longer-term, I believe they will barely tread water so I'm not expecting leadership from this sector.

China's trade numbers were good and I'm expecting another round of decent news overnight (industrial production, retail sales and GDP). Slight improvement in China's outlook will keep a bid under cyclical stocks.

Amazon, Apple and Google all look good. They are breaking through horizontal resistance and they are on buy signals. Mega cap tech stocks should move higher into earnings and that will fuel the remaining leg of this rally. Apple announces on April 25 and Facebook announces on April 27. That is when I expect this rally to peak.

Options expiration will have a small upward bias.

I believe I can catch the last leg of this rally on an intraday basis. I will be day trading and I will keep my overnight risk to a minimum. I won't be trading options the next couple of weeks. My focus will be on the market and I will be watching for signs of exhaustion.

My first options trades are likely to be OTM bearish call spreads. I can sell spreads that are above resistance and option trading strategy will take advantage of time decay as the market struggles to get through the all-time high.

Earnings season will provide us with many day trading opportunities next week. Even if the market is flat, we will catch post earnings moves. Companies that miss estimates will present the best opportunities. A lot of stocks are at the high-end of their range and good news is priced in. That means negative surprises are likely to lead to sustained declines.

We have enough positive influences for the market to inch higher today. China's economic data should provide a boost tomorrow morning and we should finish the week on a high note.

The price action will be choppy the next two weeks with an upward bias. We are only 50 S&P points away from the all-time high. The headwinds will be blowing.

Day trade from the long side today and tomorrow.

.

.

Daily Bulletin Continues...