Best Day Trades Will Be On the Short Side Next Week – Post Earnings

I FOUND THESE DAY TRADES IN A SNAP - WATCH THE VIDEO

Posted 9:30 AM ET - If you liked my video, take the free trial and see us do it in the chat room today.

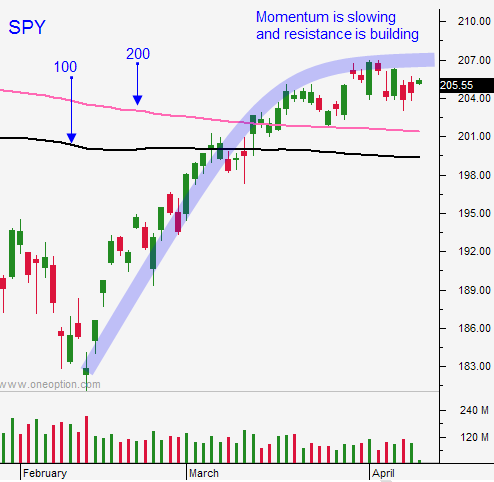

This week the market made a new high for the year and it has been able to hold the gains. Daily ranges are compressed and the market lacks a catalyst. Earnings season will crank up next week and even if the market doesn't move, there will be plenty of day trading opportunities.

IBM and Netflix will report after the close Monday. Goldman Sachs and Yahoo will report before the open Tuesday and Intel will post after the close. Microsoft and Google will report after the close on Thursday. The week will conclude with Caterpillar, GE and Honeywell Friday morning.

Mega cap tech stocks led the charge last year and I will be particularly interested in those reactions. If these stocks can't push higher I'll know the market is close to topping out. Perhaps the most interesting releases will come next Friday. Cyclicals have been surging higher and I don't believe the guidance will be robust enough to justify current price levels.

The S&P 500 is trading at a forward P/E of 17. Stocks are fully priced.

Corporate buybacks have been a huge catalyst in the last five years. Cash flows are dwindling and announced repurchases for Q1 are at their lowest level since 2012. This means the bid to the market is weaker than it has been.

China is the primary reason for the rally in cyclical stocks. Economic conditions have stabilized. Overnight China reported better-than-expected data (industrial production, retail sales and GDP), but the reaction was muted. Good results were priced in and the recent economic improvement might prompt the PBOC to take its foot off the gas pedal (good news is bad news).

I believe the market will have one more push higher and we should see the high when Apple reports on April 25. That does not mean the market will instantly rollover and tank. We could tread water for a few weeks near the all-time high and the selling pressure could take time build. I will not take short positions until technical support levels have been breached. I do see a number of storm clouds on the horizon and they should roll in a month from now.

Stocks are trading near the high-end of their ranges and negative surprises will produce sustained moves. I believe our best post earnings day trades will be on the short side.

As for today, down opens have been excellent for us. I will use extra caution this morning because oil is trading lower. That should weigh on the market. I believe we will see a gradual drift lower and the market will find support around SPY $207. There is not much news to justify a big move today so we should bounce. This is the move I will day trade. Once it runs its course, the market is likely to flat line the rest of the day. I make 90% of my money in the first three hours of trading and I probably won't trade this afternoon.

There is an OPEC meeting on Sunday. A production freeze is expected and I don't believe an agreement will spark a rally in oil Monday. Most traders realize that producers will cheat like mad.

My overnight risk exposure is tiny. There will be opportunities to sell out of the money credit spreads after earnings announcements and I will start putting a few of those trades on next week.

Option expiration will add a little volume to the market today, but don't expect much.

Find stocks with relative strength and wait for support. Buy the bounce, set targets and take profits. This might be the only move we see today and it won’t be big.

Get ready for some decent action next week.

.

.

Daily Bulletin Continues...