Market Rally Is In the 9th Inning – Watch the Reaction To These News Events

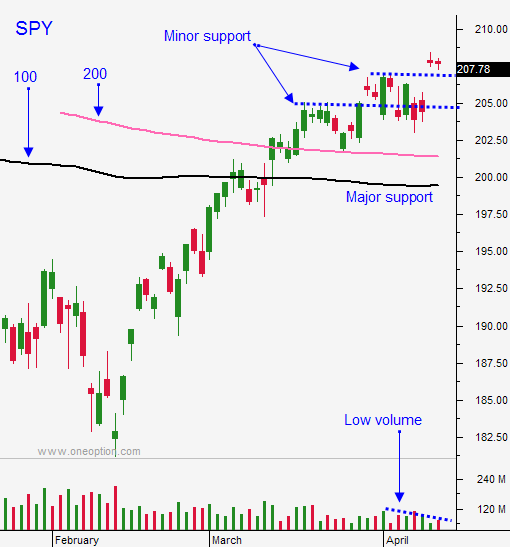

Posted 9:30 AM ET - Last week the market poked through resistance and it was able to hold the gains. Buyers are engaged as earnings season kicks off. The daily range for the S&P 500 is compressed and the volume is light. Earnings plays will provide lots of action for the next few weeks.

Stocks are trading lower this morning in reaction to a decline in oil. Global energy producers were not able to reach a production freeze agreement. This comes as no surprise. There are too many producers and most of them are strapped for cash. Even if an agreement was reached, they would all be cheating.

The ECB will meet Thursday, but I'm not expecting a change in rhetoric after they fired the bazooka a month ago.

Flash PMI's will be posted Friday. China no longer releases a flash number so it has less significance.

The focus will be on earnings. Intel posts after the close on Tuesday. It used to set the tone for the entire tech sector. That is no longer the case. PC sales were down 9.6% year-over-year and Intel will need to pick up the slack in mobile. I believe the refresh cycle in mobile is starting to lengthen and that could bear out in their guidance.

Google will post after the close on Thursday. It is a tech leader and it needs to spark buying in the sector. If it fails to do so, the upside for this market rally is limited.

The earnings Friday morning will be of greatest interest to me. Caterpillar, General Electric and Honeywell will release. Cyclical stocks have run up and I believe they are over-extended. Good news is priced in and the guidance needs to be robust. Caterpillar has already warned and I believe the reactions will be negative. Short covering and a slight improvement in China have fueled these stocks. They have been leading the charge and if they falter, the market will struggle to tread water.

It is foolish to try and short this market pre-maturely. I'm going to wait for signs of exhaustion and I will wait for technical support to be breached. I’ll tell you when I see it.

We could still see one more push towards the all-time high, but resistance will be stiff. There are storm clouds on the horizon and they are due to roll in next month.

Down opens have been very profitable for us. We will focus on day trades and we will watch for relative strength this morning. When the market finds support, we will buy stocks that are breaking through horizontal resistance on good volume.

As earnings season unfolds, I believe the best post-announcement plays will be on the downside. Stocks are trading at the top of their range and there is plenty of room for them to fall. I will be watching for a compression near the high, a breakdown below horizontal support, a sell signal for my system and a major moving average breach. If I have these elements, my success rate will be high. The move will be sustained during the day.

Trading volumes have been light.

Support is at SPY $207 and $205.

Watch the market’s reaction to these news releases. They will tell us how close we are to the top.

.

.

Daily Bulletin Continues...