Sellers Will Be More Aggressive Next Week – This Is the Last Push Higher

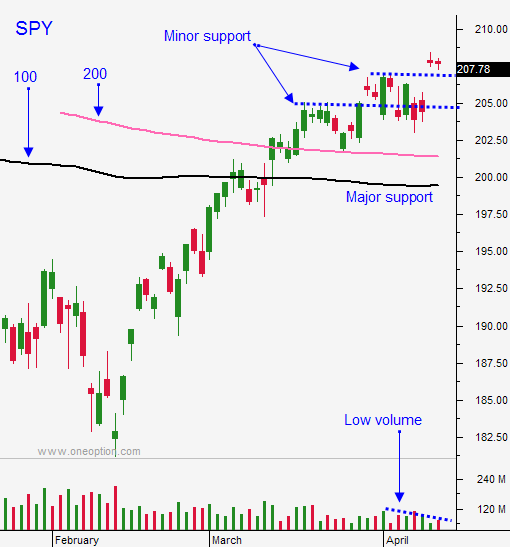

Posted 9:30 AM ET - Market continues to March higher as earnings releases heat up. Google and Microsoft announce after the close today and they need to spark excitement. Caterpillar, Honeywell and General Electric post before the open tomorrow and they will set the tone for cyclical stocks. This is the final push for this rally and we are likely to poke through the all-time high next week.

The ECB made dovish statements this morning and QE will continue for another year. Flash PMI's should be in line tomorrow morning and I'm not expecting a big reaction.

The earnings tomorrow morning are of greatest interest to me. Cyclical stocks have led the charge and they are overextended given the macro backdrop. Earnings will be decent, but the guidance will not be as robust as expected. Perfection is required at current price levels and I believe these stocks are stretched.

Caterpillar has already warned. AA lowered revenues guidance last week. BHP's CEO said that the spike in iron prices is temporary and it will run its course in the next month or two.

Apple reports on Tuesday, Facebook on Wednesday and Amazon on Thursday. These mega cap tech stocks have the potential to drive the market. Asset Managers who are under allocated will be trying to buy stocks ahead of the releases. Shorts who have been anxious to fade this rally will be less fearful after these earnings announcements. I expect to see a nice rally before the numbers and I expect to see stronger resistance after next week.

The FOMC statement will be more hawkish. Global risks have subsided and they have kept the Fed on the sidelines. Many traders believe that the PBOC will take its foot off of the gas as well.

Corporate cash flows are falling and buybacks are at their lowest level since 2012 in Q1. This means that the bid for stocks is weaker.

The events during the next week will be very telling. I'm expecting a decent rally into the FOMC and resistance after it. I am NOT looking for a sustained decline afterwards.

Market tops take time to form. We will poke through the all-time high, challenge it again and eventually roll over. This process could take a few weeks or more.

I will continue to day trade and the majority of my activity will be on the long side today.

However, I am trading both sides. With stocks near their all-time high, the greater risk is on the downside. Stocks that disappoint will be punished and that is where we can see sustained moves. I am constantly looking for good shorts too.

The market should post nice gains today ahead of GOOG and MSFT.

.

.

Daily Bulletin Continues...