Market Will Provide A Big “Tell” On Friday – Watch the Earnings Reaction

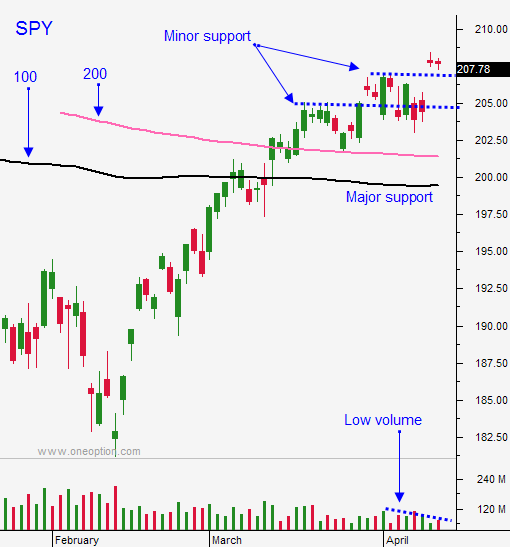

Posted 9:30 AM ET - Monday the market ignored a drop in oil and it surged higher. Yesterday, the gap up held and the S&P 500 is one good day from its all-time high. Earnings season is upon us and this type of bullish price action is typical. I still believe we have one or two more weeks of positive price action.

Intel beat estimates yesterday, but the numbers were pretty much in line. Tablet sales were down 44% year-over-year. I believe the mobile refresh cycle will lengthen and that could be bad for Microsoft/Apple. PCs sales were down 4%.

Google and Microsoft will post after the close Thursday and General Electric, Caterpillar and Honeywell will post before the open Friday. These results will be very telling.

Tech stocks have not been leading the charge and we need to see strength in this sector if the market is going to challenge the all-time high. Cyclical stocks have run up dramatically and we will see if the guidance is strong enough to justify current price levels.

The ECB will release its statement tomorrow morning. I am not expecting anything new. They fired the bazooka last month and they will evaluate the effect.

Flash PMI's will be posted Friday morning, but the results lack punch since China no longer participates.

Individual earnings reports will provide us with plenty of action. We will be focusing on the pattern we trade and we will be looking for horizontal breakouts/breakdowns. These formations produce sustained moves when combined with buy/sell signals from my trading system. I believe the best moves will come on the downside since stocks are trading at their highs of the year. There is plenty of downside for companies that disappoint.

My longer-term bias is bearish, but I won't stand in the way of this freight train. I have been able to capture this entire rally without taking overnight risk. I am constantly watching for signs of exhaustion. When I see it and when I have technical confirmation, I will prepare to get short. Until then, I will enjoy the ride.

The market should be able to grind higher until Apple announces on April 25. After that, I believe resistance will build.

We've had an excellent week in the chat room. If you want to see the pattern we trade and the searches that deliver these candidates, take the free trial.

The market is flat this morning and I will use the first hour range as my guide. There are plenty of day trading opportunities on both sides of the market.

Option implied volatilities have declined substantially and that is bad for premium selling option trading strategies (credit spreads). The market momentum is slowing and stocks that are up one day are down the next. This makes it difficult to buy calls and time decay is a factor. It is way too early to buy puts. Consequently, I am not doing much option trading at this time.

There will be opportunities to sell bullish put spreads and bearish call spreads after earnings releases. I will try sell way out of the money and I will try to stay balanced (bullish and bearish trades). I don't want to have a lot of overnight exposure so this will be a small portion of my overall trading.

.

.

Daily Bulletin Continues...