Market Rally In Danger – Earnings Disappoint – Downside Will Be Tested Today

WE WILL BUY PUTS TODAY - WATCH US IN THE CHAT ROOM - TAKE THE TRIAL

Posted 9:15 AM ET - Yesterday we saw a light round of profit-taking and the S&P 500 closed on its low of the day. I would not normally give this much thought, but it is unusual price action ahead of two major earnings reports. Microsoft and Google both missed expectations after the close. I was looking for a good number from Google and it was going to serve as a catalyst for the final push higher. We are one good day from the all-time high, but I'm not as confident we will get there.

In addition to Microsoft and Google, Visa, Starbucks, General Electric, Caterpillar and Honeywell are all trading lower after posting earnings. Cyclical stocks are stretched and I believe they are ripe for a pullback. I will be looking for shorts in basic materials and heavy equipment.

Apple will post on Tuesday and they have the potential to disappoint. Intel reported that laptop sales were down 4% and tablets were down 44%. PC sales were also weak. The new iPhone was intended for Chinese consumers – it certainly did not generate excitement in the US. I also believe the refresh cycle in cell phones is lengthening. Apple has been drifting lower the last few days and the price action is weak.

Facebook should post a good number. Mobile ads will fuel revenue growth. Amazon is a tough call since earnings have never been a focal point.

Bears will get more aggressive once these mega cap tech stocks have reported. I also believe we will see more profit-taking. I am not looking for an immediate decline that is sustained. This top will take time to form and we need to wait for technical confirmation before we aggressively short. The market has been in a nice grind higher, and now we should expect to see some down days.

Option implied volatilities are very low and options are cheap. I will take a few overnight put positions ahead of the FOMC.

Global economic conditions have stabilized and this was a primary concern for the Fed. This should come out in their statement and it will be construed as "hawkish" next Wednesday. Many traders believe that China will take its foot off of the gas pedal. This rally has been manufactured by central banks and the market is addicted to easy money.

In my comments you know that I've been looking for one nice push higher through Apple earnings. We've have seen it and I believe the market will start topping out.

The news was bearish overnight and I believe the bid will crumble this morning. We saw a little weakness yesterday and buyers will be passive this morning. They want to gauge the selling pressure.

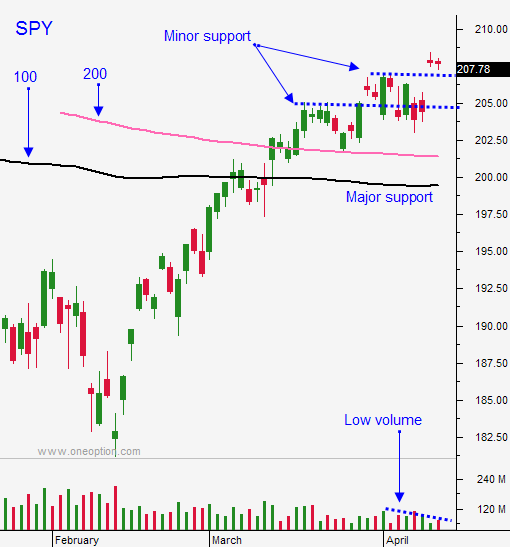

I will focus on the short side today. There is support at SPY $208.30 and $207. If we make a new low after the first hour and the market continues to drift lower, I will purchase a few puts to hold over the weekend.

If by chance my analysis is wrong and the market makes a new high after the first hour, I will go with the flow and I will day trade from the long side. Traders will be cautious heading into the weekend and this scenario is less likely.

Watch for signs of exhaustion. In the next couple of weeks we might be set up for an excellent shorting opportunity.

.

.

Daily Bulletin Continues...