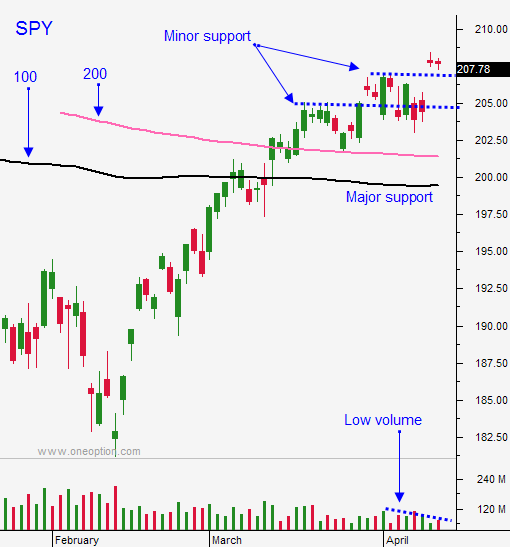

Market Will Hit Speedbumps This Week – Profit Taking Will Surface

Posted 9:50 AM ET - Last week the market tried to challenge the all-time high, but it was turned back. Earnings announcements did not generate excitement and resistance is building.

Netflix, Google, and Microsoft disappointed the market. Mega cap tech stocks are not participating in the rally and I don't see a catalyst. Apple postponed their earnings release by day and I believe the news will be negative. Facebook should be okay on Wednesday and Amazon will be a crapshoot on Thursday (earnings are not always the focal point with the stock).

Cyclical stocks will also struggle. Honeywell, General Electric and Caterpillar were down after posting results last week. The macro backdrop is fragile and I believe these stocks are priced for perfection.

Financials will struggle in a zero interest rate environment. The Fed has been dovish and that will keep a lid on these stocks.

Oil producers will pump like mad. They need the money and the rally in energy stocks should hit resistance.

United healthcare (the nation's second-largest HMO) announced that they will exit most state insurance exchanges. They are losing money on Obamacare and this could be a warning sign for the rest of the group.

Retail has been soft all year and deep discounts are needed to lure consumers in.

I don't see a catalyst to push the market through to a new high. Stocks are priced at a forward P/E of 18 and they are fairly rich.

Corporate cash flows have declined and Q1 stock repurchase announcements are at their lowest level since 2012. This will weaken the bid.

Global credit concerns have subsided and central banks will take their foot off the gas pedal. This has sparked the recent market rally and that catalyst is gone.

My bias is decidedly bearish, but I need to temper it. The rally in the last two months has been very strong and this move will take time to top out.

We could see a nice little pullback this week after Apple and the FOMC.

I will be looking for a few good shorts and I will buy some overnight puts. I'm not expecting a huge sustained decline so I am not loading up - yet.

The market will chop around for a few weeks and resistance will build. We need to see that type of price action and then we need technical breaches before we aggressively take bearish positions.

I will day trade this week and I will use the first hour range as my guide. Look for weakness in the back half of the week.

.

.

Daily Bulletin Continues...