Market Support Held – Back In Day Trading Mode – These Day Trades Are Ready Now

CHECK OUT THESE DAY TRADES - TOP PROSEPCTS READY TO TRADE NOW - TAKE THE FREE TRIAL

Posted 9:45 AM ET - I recorded this short video this morning. This makes day trading so much easier. WATCH IT NOW

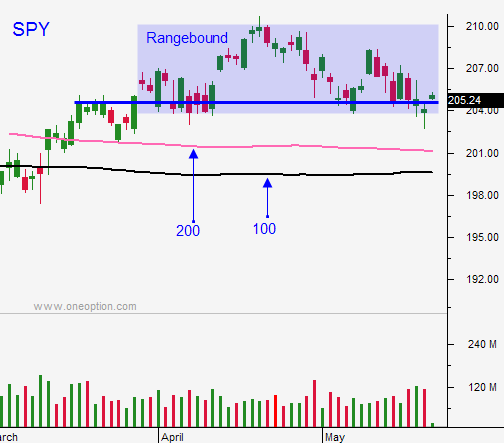

Our best chance for a market move passed us by yesterday. Major support at SPY $204 was tested and the selling pressure was not strong enough to keep us below that level. Buyers nibbled and the SPY recouped most of its intraday losses. We are back in the middle of the trading range and the action is going to slow down dramatically.

Flash PMI's will be posted Monday and I'm not expecting much of a reaction. China has been a focal point for global markets and they do not participate in the flash number.

Pre-holiday trading will set in and daily ranges will be compressed.

When we come back from Memorial Day, the jobs report will be on our doorstep. It will not be strong enough to prompt a rate hike in June.

After that, the next major event will be the FOMC on June 15th. The market got spooked this week when Fed officials were more hawkish than expected. It's important to realize that the last meeting took place before the dismal jobs report was released. If the Fed had those numbers, the tone would have been softer. If you add another jobs report below 200K, there is no way they will hike. The timetable will shift to September. Personally, I believe a rate hike is unlikely before the November election.

The Brexit vote is set for June 23rd. Polls suggest a close battle, but England is likely to stay in the EU. The market will price this in, but we could see jitters ahead of the vote.

We needed SPY $204 to fail yesterday if we were going to challenge $200. It did not happen and it is less likely to happen now that this window has passed.

I own July puts on a handful of stocks. They are weak relative to the market and I want to see them drifting lower as the SPY treads water. If they start to rebound, I will exit the positions.

I also own BZQ. This is a longer-term bearish position and I will hold it. BZQ did well yesterday.

Day trading is my bread-and-butter. This week I released a day trading algorithm that rates prospects. Stocks that rise to the top of this list are ready to trade immediately. I added a table to my chat room so that bullish and bearish trades are easy to access. They update dynamically every minute and real-time charts are included. This is the only resource you need for day trading. Take the free trial and watch us make money today.

Look for an early move higher and a tight range the rest of the day.

I make 90% my money in the first two hours of trading and I don't plan on trading this afternoon. Without a market tailwind, I will set targets and take profits.

As much as I'd like to see sustained market movement, there is something refreshing about day trading for a couple of hours and calling it quits. I have very little overnight risk and I sleep well.

Get ready for a quiet stretch ahead.

.

.

Daily Bulletin Continues...