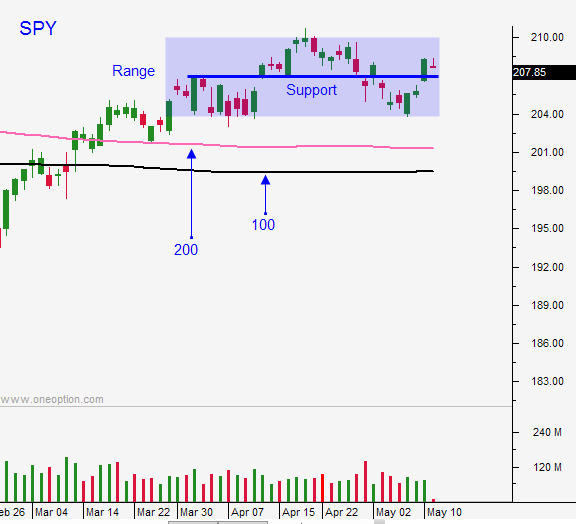

Market Will Break Down – Steady Selling Likely – Use SPY $204 As Your Guide

Posted 9:30 AM ET - Yesterday I said that the market was going to do what it wanted to do and that the FOMC minutes would be cited as the reason for the move. Sellers did not like the hawkish comments and the market sold off after the release. We are seeing follow-through this morning and major support will be challenged at SPY $204. I will use that level as my guide.

The Fed's tone was more hawkish a month ago and they said the probability of a rate hike has increased as global risks subside. We already knew this and the comments should not have come as a surprise. The last FOMC meeting happened before the dismal jobs report and the tone would have been softer if they had those numbers ahead of time.

There will be one more jobs report before the next Fed meeting and I don't believe it will be strong enough to justify a rate hike. In fact, I don't believe the Fed will hike before the November election. What I believe doesn't matter. Traders are pricing in a higher probability of a rate hike and in the absence of other news, it will weigh on the market.

The rate hike in December sparked selling the first two months of the year. Central banks around the world countered that with easing and we got the bounce in March and April. Central banks are moving the market. The tone has become more hawkish and we are seeing profit-taking.

The most likely scenario this morning is an early drop that takes out $204. That will trigger stops and we will hit a small air pocket. Buyers will step in and the market will rally back above $204. Once the bounce stalls, the next wave of selling will begin and it will be much stronger. This scenario needs to unfold in the first hour of trading. Watch for very quick movement back and forth and sustained selling the rest of the day.

The second scenario is a gradual drift lower. Support at SPY $204 is breached and we drift lower the rest of the day. We could hit a selling climax that takes us down to SPY $202. The 100-day MA is below that and buyers should start to nibble before we get there. This scenario would take us lower than the first scenario.

In both cases I believe the market will decline today. I will be trading from the short side. If support at SPY $204 is breached I will by puts and carry them overnight. There are many stocks that have broken horizontal support and they are weak relative to the market.

I am long BZQ (bearish position) and I've been mentioning it in my comments every day. This trade is going to pay off big-time today. If the selling pressure remains constant all day, I will continue to hold it.

Rising interest rates are bad for emerging markets and Brazil is in bad shape. This is one of the best shorts I've seen in a while and I hope you've taken a position.

Look for steady selling today.

If by chance the market bounces and $204 holds, we could drift back into the range next week. That would be the worst-case scenario since trading volumes will dry up ahead of Memorial Day.

Take short positions with the intent to hold overnight if we close below $204.

.

.

Daily Bulletin Continues...