Make Your Money Early and Stop Trading – Light Volume and Tight Ranges This Week

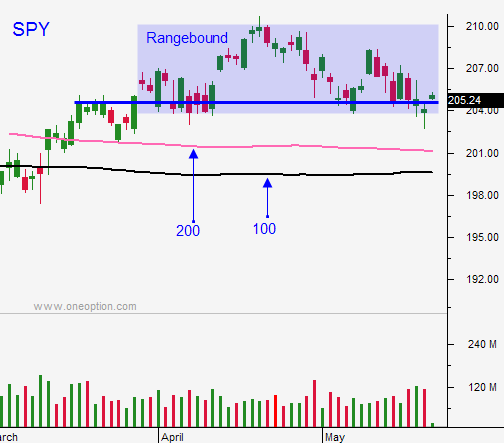

Posted 9:45 AM ET - Last week we had a small window of opportunity for a market move and it passed us by. The SPY was on a significant support level ($204) and traders were spooked by hawkish Fed minutes. If that support level had failed, stop orders would have been triggered and we could have slipped to major support at $200. Profit-taking was not strong enough to overpower buyers and we drifted back into the range. Unfortunately, trading volumes will decrease this week and the daily ranges will be tight.

Flash PMI's did not have much of an impact and the same will be true for durable goods orders and GDP when they are released later this week.

Traders will take time off and we will fall into light preholiday trading.

Next week the jobs report will be released. Temporary employment agencies are reporting soft conditions and we should see a number below 200K. That will keep the Fed sidelined and it will take some of the pressure off of the June FOMC meeting (June 15).

The Fed minutes might have been more hawkish than expected, but remember that the meeting took place before the dismal jobs report. If Fed officials had that information, their tone would have been tame.

Central banks have eased and they will evaluate if further action is required. Interest rates are near historic lows and that is keeping equity markets afloat. Stocks are fully valued so they don't have much upside. Credit concerns are low so the bid is fairly strong. These forces are offsetting each other.

There is nothing to push the market. The news is light and there is not a catalyst. If you look at a one-year chart you will see that the SPY was in a tight range from June through August last year. We can expect similar price action this year and the summer doldrums will come early.

Greece needs to secure financing and that is likely to happen. England will vote to stay in the European Union (polls indicate they will). These are the only two events that could spark selling.

In the absence of market direction, I am not buying options. I have a few put positions that I will exit today. They will be small losers. Option premiums are cheap and I am not doing much credit spreading. I have to go too close to the money and I don't feel like I'm being properly rewarded for the risk I’m taking.

Last week I launched my new day trading algorithm. It scores day trades and the most attractive candidates rise to the top. They are ready to trade the instant they hit this list and the results have been incredible. This is working incredibly well and I have no reason to shift away from day trading. I'm keeping my overnight risk to a minimum.

We should see an overnight move and some activity in the first 90 minutes of trading. I plan on making my money early and I will set targets knowing that I don't have a market tailwind. After two hours, I plan to call it a day.

I make 90% my money in the first two hours of the trading day and I plan on taking afternoons off this summer.

If you're a day trader you should take my one-week trial and check out this new system. You will be amazed.

Keep it small and make your money early.

.

.

Daily Bulletin Continues...