Market Not Pricing In Risk Of Brexit – Surprise Favors A Vote To Leave the EU

Posted 11:20 AM ET - Yesterday the market opened on a positive note and it continued to grind higher. Janet Yellen's comments were dovish and we are within striking distance of the all-time high. The price action this morning has been bullish and the action will quiet down ahead of the FOMC meeting.

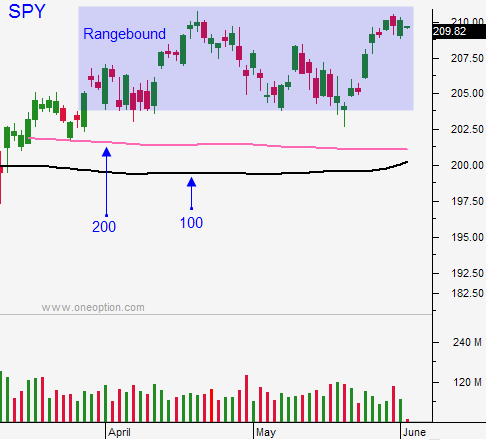

As I mentioned in yesterday's comments, I am expecting a bullish week. We will see some resistance at SPY $213 and that level should hold this week.

The Fed will not hike and the tone will suggest that interest rates are not likely to go up before September. Much of that is already baked into the market. We don't have any other catalysts this week so we could grind higher. Bear's will not stand in the way of this rally.

The Brexit vote is on June 23rd and polls suggest it could go either way. If England leaves the EU global markets will be rattled and credit concerns will surface. I believe the SPY could fall 10%.

I will be buying VXX and I might buy BZQ towards the end of the week. I want all of the Fed euphoria to run its course.

I am day trading from the long side and I will continue to do that the rest of the week.

A dismal jobs report and Brexit will keep the Fed's remarks on the dovish side. The risk of hawkish comments is extremely low.

Look for a drift higher and resistance at SPY $213.

It is hard to believe we are close to making a new all-time high after the horrible start to the year.

.

.

Daily Bulletin Continues...