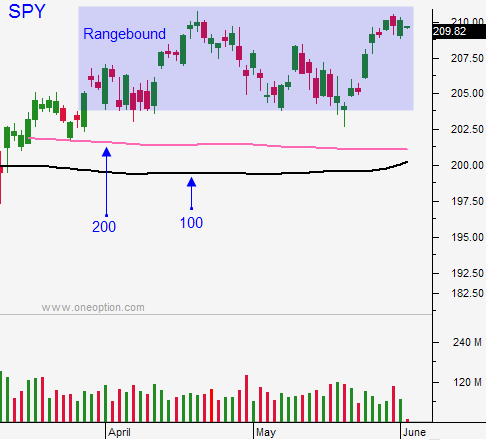

Price Action Mildly Bullish – Nothing To Stand In the Way of the Rally

Posted 9:50 AM ET - The market inched closer to the all-time high yesterday and it backed off late in the day. Trading volumes are light and I wouldn't read too much into the move. We want to see if a pattern of late day selling develops. I'm expecting bullish price action this week.

The FOMC is a week away and Yellen's dovish comments are fueling this rally. There is no way the Fed will hike after a dismal jobs report.

England's vote to stay/leave the EU is in two weeks and this will be the biggest market mover the summer. A vote to "stay" could add 3% to the S&P 500 and we could make a new all-time high. The market is pricing this in and it is discounting a vote to "leave". That means the risk is to the downside.

If England leaves the EU, currencies will fluctuate wildly and credit risks will surface. This scenario could lead to a 10% decline in the S&P 500.

Until that vote, I am expecting bullish price action. If VXX continues to decline and emerging markets rally, I will take some short positions ahead of the vote.

Day trade from the long side and set targets. When I get on a move, I exit when I see the stock compress. If it breaks out to the upside I buy it and exit on the next compression. I'm also keeping one eye on the market.

Resistance is stiff at the all-time high and we can't count on a market tailwind when we trade from the long side. That's why it's important to take profits along the way.

I will also exit trades if the market starts to weaken. Make sure to keep one eye on the SPY and the other eye on the stock.

Trading volumes are light and you have to make your money early in the day.

Dips will be brief and shallow - favor the long side.

.

.

Daily Bulletin Continues...