Bullish This Week But Possible Trouble Next Week – Brexit Would Spark Selling

Posted 9:40 AM ET - Last Friday the jobs report came in at 36,000. That was a substantial miss and 160,000 new jobs were expected. The market sold off on the news and it found support after an hour of trading. It spent the rest of the day recovering and the SPY is back above $210.

I don't trust this jobs number and I am expecting a big upward revision. ADP came in at 174,000 and that number is much more reliable. The government's numbers are always filled with seasonal adjustments and they rely on government offices to report unemployment claims on a timely basis. In any regard, this dismal number will keep the Fed sidelined.

Janet Yellen will speak today at 12:30 Eastern time. I am expecting dovish rhetoric and the market should rally on the news. The FOMC meeting on Wednesday will also be dovish. Soft employment conditions will be cited as the reason for keeping rates low, but there is a bigger issue at hand.

Next week England will vote to stay in the EU or to leave it. The market has priced in a "stay" vote but recent polls suggest that the "leave" vote is growing and it has a 2% edge. If England decides to leave the EU, credit markets will fluctuate wildly and credit risk will increase. The greatest surprise is on the downside.

I believe that a "leave" vote could lead to a 10% market decline. It will take the SPY down to $190. EU officials disappear during the summer and fear will fester. This outcome would keep the Fed sidelined in July and the market should bounce off of that level.

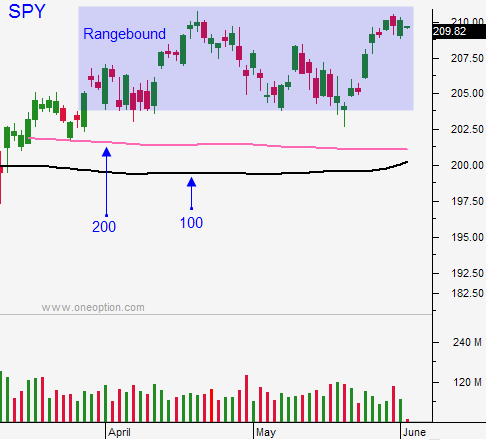

If England votes to "stay" I believe the market will rally to a new all-time high. It will barely poke through and we will spend the next two months chopping around. There is much less upside to the market than there is downside.

Look for bullish price action this week. I have been making most of my money day trading from the long side and that will be my focus this week.

I will be buying VXX on Friday. I believe there's a chance that Brexit could happen and that would shock the market.

Focus on the long side this week and keep your overnights to a minimum. The volume will be good today, low tomorrow and decent the rest of the week.

.

.

Daily Bulletin Continues...