Buy This Market Dip – Bullish Specs Were Flushed Out – FOMC Will Be Dovish

Posted 9:40 AM ET - I mentioned in my comments last week that the market was due for a nasty day. Stocks dipped last Friday and the market drifted lower the entire day. We are seeing some profit-taking and traders are nervous ahead of the Brexit vote on June 23rd.

Yesterday's massacre in Orlando was tragic and my heart goes out to all of the victims and their families. From a trading standpoint, this horrific event will not have a lasting market impact. We can look back at all of the terrorist attacks in recent years and they don't even register as a blip on the radar.

The early decline can be attributed to selling pressure that started last week. Asset Managers do not want to chase stocks near an all-time high so they have pulled their bids. Bullish speculators are getting flushed out and they are bailing out of positions. We should see support today and it will lead to a nice little buying opportunity.

China's industrial production and retail sales numbers were inline.

The FOMC meeting on Wednesday will be dovish. The Fed will tone down its rhetoric after a dismal jobs report and ahead of a very important Brexit vote. The market will like the tone and stocks will rally after the meeting.

I will be waiting for support today and I will be buying stocks that are strong relative to the market. I am keeping my overnight risk at a minimum and I am focusing on day trading.

If the market stages a nice rebound this week, I will buy VXX and BZQ. I plan to hold these two positions into the Brexit vote.

A betting parlor in England suggests that there is a 65% chance that England will stay in the EU. That is down from a 77% probability last week. Recent polls suggest that the "stay" vote has a slight edge. The market is discounting the possibility that England will leave the EU and any surprise favors the downside. If the polls remain balanced, investors will get nervous and option premiums will rise (bullish for VXX). Credit risk will also start to increase ahead of the vote. I have not decided if I'm going to stay long BZQ and VXX during this event.

The LinkedIn deal this morning will strengthen the market bid.

For today, wait for the lows to be established. Find stocks with relative strength and day trade from the long side.

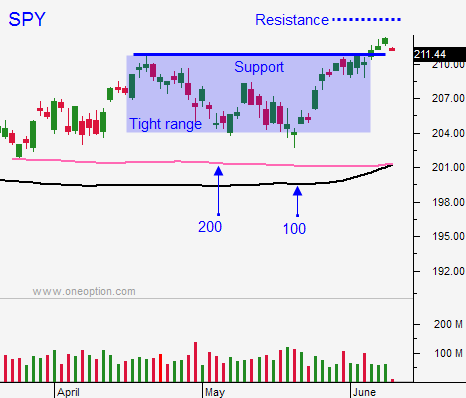

Support is at SPY $209 and $207.50.

.

.

Daily Bulletin Continues...