Market Due For A Nasty Day – Bullish Speculators Will Get Flushed Out

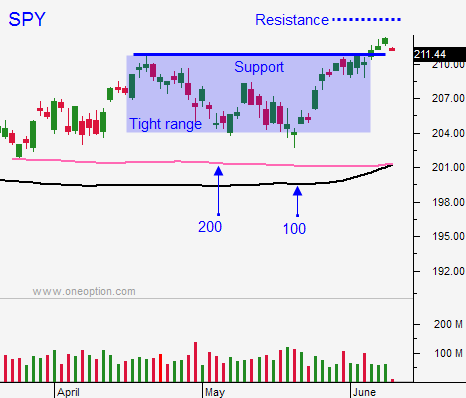

Posted 9:30 AM ET - The market opened lower on Thursday and it spent the entire day trying to recover. It did not make it into positive territory and we are seeing a little profit taking this morning. The S&P 500 is down 15 points pre-open and support at SPY $210.80 will be tested right away.

I am not expecting prolonged selling ahead of a dovish FOMC. This dip should run its course in a couple of days.

We have been making money buying into early selling. We need to be cautious today. Asset Managers are not going to chase stocks near an all-time high and they will pull bids to gauge the selling pressure. If we make a new low for the day after the first hour of trading, the momentum will be set and we will drift lower.

I mentioned yesterday that the market has a way of keeping traders honest. Buying into this rally was too easy and bullish speculators will be flushed out today.

Let the early wave of selling run its course. Wait for support and buy stocks that want to move higher (relative strength). They will be easy to spot because they are up. Here is the key: DON’T OVERSTAY YOUR WELCOME.

I don’t know if the bounce today is going to hold. In fact, I suspect that it will not. Set targets and take profits along the way. If that bounce fails quickly and we take out the low of the day, focus on the short side.

I have no overnight exposure and my entire focus has been on day trading this week.

On the next rally (FOMC) I plan to buy VXX and BZQ. Brexit is a big deal and many are citing that as the reason for the selling pressure today. This event has been discounted and it could be the biggest news of the summer.

Recap: wait for support and play the bounce. Set targets and take profits. Next wait for the low of the day to be tested. If it fails, trade from the short side (energy and financials) the rest of the day. If support holds, focus on longs.

Daily Bulletin Continues...