Buy This Market Dip – Day Trade From the Long Side Ahead of Dovish FOMC

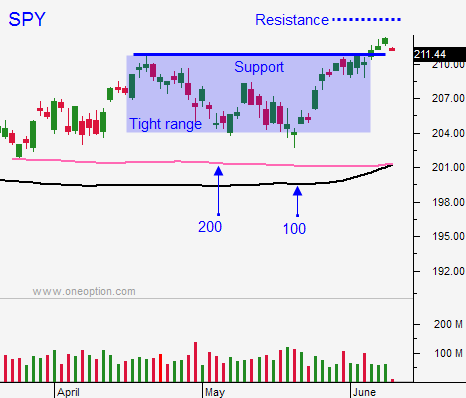

Posted 9:20 AM ET - We are starting to see some profit-taking. The market drifted lower the entire day Friday and it closed on its low. Bulls tried to support the market yesterday and they threw in the towel. The bid deteriorated throughout the day. The SPY closed below support at $209 and this morning it will test support at $207.50.

Asset Managers do not want to chase stocks at an all-time high ahead of the FOMC and the Brexit vote. They have pulled bids and they are gauging the selling pressure. We won't see a bounce today until we hit an air pocket. Buyers want to see a low and a meaningful bounce before they start buying.

I believe $207.50 could attract buyers.

The FOMC statement will be dovish and I'm expecting the bid to strengthen today. The tone from the Fed should be tame and we should see a nice little rally into quadruple witching.

Polls are suggesting that the "stay" vote in England has a slight edge. No one expected it to be this close. The market hates uncertainty and we are likely to see some nervous jitters next week.

I will be waiting for market support today and I will be trading from the long side.

The action will slow down dramatically after a couple of hours and we will be "dead till the Fed".

Try to make your money early and focus on the long side.

.

.

Daily Bulletin Continues...