Jobs Report Is Garbage – Follow ADP – Market Likes the News – Goldilocks

FREE TRIAL - FOLLOW OUR TRADES IN THE CHAT ROOM

Posted 9:25 AM ET - Today's jobs report is just another example of an inept government agency. For years I've been telling you to follow ADP. They process payrolls for small and medium-size businesses and they have their finger on the pulse of the economy. ADP has no hidden agenda and the numbers are an accurate reflection of employment.

On the other hand, you have a bureaucracy trying to piece together scattered bits of information. They rely on accurate and timely data from local offices. The Bureau of Labor Statistics (BLS) also has seasonal adjustments and they periodically drop people from the employment pool. The BLS itself stated that the employment numbers were manipulated before the 2012 election. Don’t trust their numbers.

This morning we learned that May's job growth was revised downward to 11,000 and June's job growth was 287,000. What a bunch of crap. The local offices probably took some extra time off during Memorial Day and no one cared if the numbers were accurate. The three-month average is 147,000 and that is a "Goldilocks" number. It is strong enough to suggest sluggish growth and it is weak enough to keep the Fed on the sidelines.

We learned from the FOMC minutes on Wednesday that the Fed is dovish. ISM services came in much better than expected and job growth is better than feared.

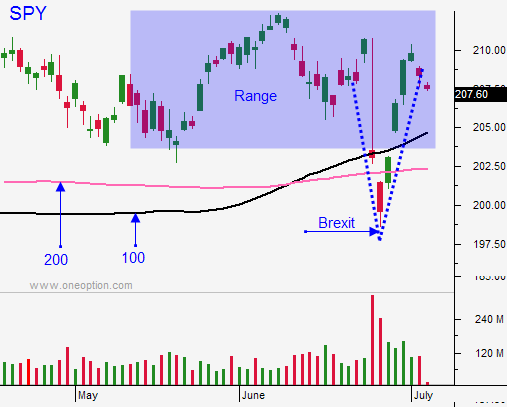

The market is addicted to easy money and it loves the news (decent growth and no rate hike). The S&P 500 is up 15 points before the open and we will challenge major resistance this morning.

I have a handful of overnight long positions. I've been keeping my risk exposure very small so I don't want to make it seem like I've been bullish. I had some stocks that were very attractive technically and I held them overnight. I will take profits during the early surge this morning. That is my first course of action.

This gap higher will fuel a number of breakouts. Some will be the real deal and some will be fakes. I will let the early action unfold and I will wait for a pullback. This market retracement will help me identify the "real McCoy's". Resistance should be relatively stiff and it's important to note that the news was not great.

It is possible that stocks gradually pullback all day.

The first hour range is always a great guide for day trading. If we are below the first hour low, favor the short side. If we are above the first hour high, favor the long side. This tactic will work today.

Earnings season begins next week and that typically attracts buyers. I'm expecting a decent bid today and I feel that after a brief pullback this morning stocks will grind higher. I have been finding better candidates on the long side this week and I am more inclined to look for those opportunities.

The key today is to take profits early on your longs and to stay flexible. Be patient and use the first hour range as your guide.

We are only 20 S&P points away from the all-time high and we are likely to challenge it in the next couple of weeks.

.

.

Daily Bulletin Continues...