Market Will Poke Through the All-time High – Day Trade Using This Tactic

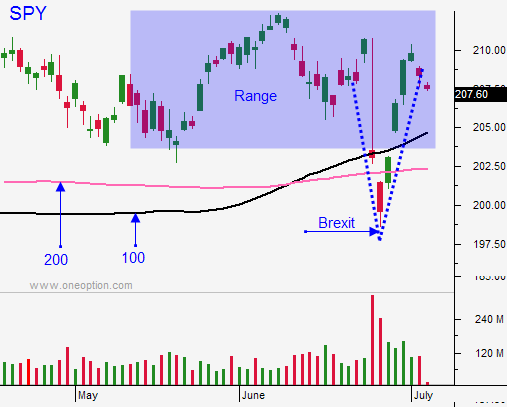

Posted 9:30 AM - Last week the market surged on dovish FOMC minutes and a better-than-expected jobs report. The three-month average for job growth is 147,000. That is good enough to stave off recession fears and is not hot enough to justify a rate hike. This is a Goldilocks number and the market is challenging the all-time high.

Earnings season will start today, but the announcements really don't crank up until next week.

China will post industrial production and retail sales on Friday. These are really the only significant economic release this week.

The strongest companies announce early in the earnings cycle and optimism builds quickly. I believe the market will poke through the all-time high in the next couple of weeks. Corporate profits will not impress and the upside is fairly limited. This rally will peak after the FOMC statement on July 27th. Mega cap tech stocks will have announced and profit-taking will set it.

Credit issues typically start to surface in August when politicians are vacationing. Brexit has been completely discounted and many believe that England will negotiate terms to stay in the EU. Italy's banks are laden with bad debt and there is no question that the EU is weaker without England (second largest economy in Europe).

I am going to day trade from the long side. However, greater caution needs to be used on days when the market gaps higher. All stocks rally with the market and it's difficult to identify relative strength. Once the early market momentum stalls, many stocks pullback and they never recover. Then you are stuck with losses and you might be tempted to carry the position overnight (risky). Don't get caught in this trap. Be patient and wait for the market to compress or pullback. Stocks that have relative strength will be much easier to spot after an hour of trading.

I prefer to day trade stocks that have been beaten down and that have formed a solid base. They have plenty of upside and they won't need as much help from the market. Stocks that have compressed and that are breaking through horizontal resistance are excellent. Ideally, they will have cleared one or both of the major moving averages (100-day or 200-day).

Use more caution when buying stocks that are breaking out to a new high. These are major resistance levels and these stocks need a nice tailwind (help from the market).

I can't fully embrace the market breakout until it holds for at least a week.

On days when the market opens lower, wait for support and scoop stocks. These will be our best trading days and relative strength will be easy to spot.

The news is pretty light this week. Be patient and trade from the long side.

.

.

Daily Bulletin Continues...