Friday Jobs Number Will Be Market Neutral – Use the 1st Hour Range As Your Guide

Posted 9:00 AM ET - Yesterday the market probed for support early in the day and buyers stepped in. As I mentioned in my comments, the bid would strengthen ahead of the FOMC minutes. We traded from the long side and had excellent success. ADP came in at 172,000 and the market is flat before the open. Trading should be relatively quiet today.

The jobs report tomorrow should come in around 170,000 and May's number should be revised upwards. Anything in a range between 100,000 and 200,000 will be market neutral. The Fed meets in three weeks and no one is expecting a rate hike.

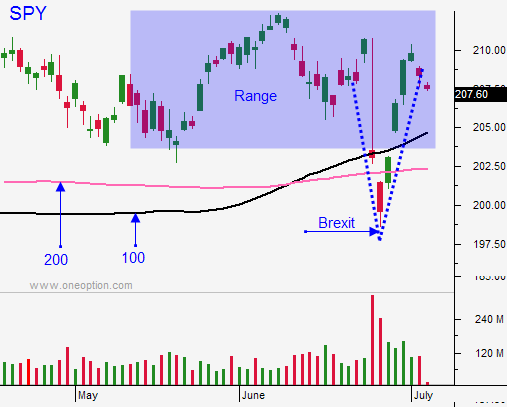

Sluggish economic conditions and Brexit will keep central banks from tightening.

Earnings season starts next week and that will keep a bid to the market. The strongest companies announce early in the cycle and the market will try to challenge the high. We should see profit-taking after Apple announces on June 26th and after the FOMC on June 27th. August and September are bearish months and the all-time high should hold.

This is a difficult environment for option trading. Option buyers are exposed to time decay and there is no momentum. Option sellers are not properly rewarded for the risk they are taking. Implied volatilities are low and you have to sell close to the money to generate income. One small market move can spell disaster for credit spreads.

This is a day trading environment. Stocks tend to have good rotation on an intraday basis and the moves have decent follow-through. Unfortunately, stocks that are up today are down tomorrow and it doesn't pay to hold positions overnight.

I've been day trading my system with great success and there's no reason to change my strategy. Today I will use the first hour range as my guide. If the market is above the first hour high I will favor the long side. If the market is below the first hour low, I will favor the short side. The quality of trades has been better on the long side so I have a slightly bullish bias for my day trades.

Last week I suggested selling out of the money bullish put spreads when the market bounced off of major support. Those positions are doing well.

Stick to day trading and use the first hour range as your guide. Take my free trial and I'll show you how we do it in the chat room.

.

.

Daily Bulletin Continues...