MSFT Should Post Solid Results – Dips Will Be Brief and Shallow In July

Posted 9:30 AM ET - The trend is up. Earnings season is upon us and Microsoft will post after the close. Intel will announce after the close tomorrow and these two stocks will set the tone for the tech sector. I'm expecting decent results (especially from Microsoft). Stocks should grind higher this week, but the probability of an "ugly day" is high.

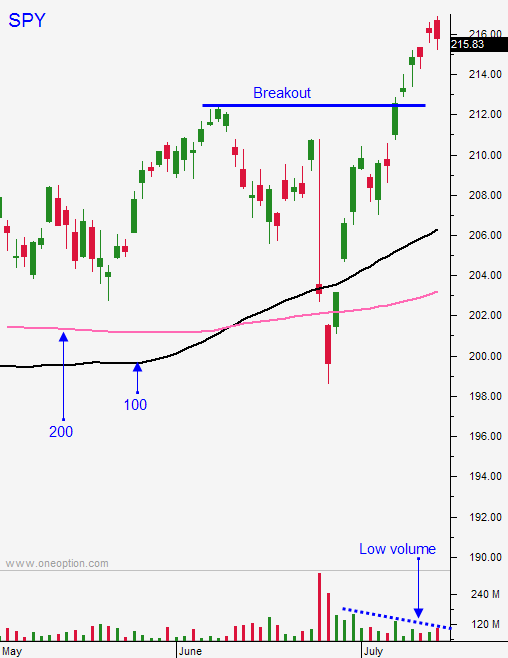

The S&P 500 has been able to close above major horizontal resistance for over a week. I am starting to embrace this breakout and I will wait for a buying opportunity. Any pullback will be short and brief this week.

Mega cap tech stocks will start posting and no one wants to be short into these earnings announcements. Consequently, I believe the market will inch higher until Apple reports next week.

The FOMC meeting a week from Wednesday will also keep buyers engaged. The employment picture is strong enough to support sluggish growth, but not robust enough to prompt a rate hike. No one expects the Fed to raise rates.

I am forecasting bullish price action the rest of the month.

When we do get a dip, I will wait for support and I will buy a few stocks (calls) with the intent of holding them overnight. I won't go gonzo because I believe that the final push higher will run its course in the next two weeks.

In August we should see a round of profit-taking. Credit issues will start to surface and August is typically a soft month. Furthermore, earnings will fail to impress and valuation will become a concern. Traders will fear a rate hike in September and that will also add to the selling pressure.

You should be long calls and those positions should be in great shape. Gradually scale out of positions. Set targets and take profits.

I have been day trading this breakout and I have been able to find 4-5 good trades each day. That is my focus and patience is critical. Most days I am done trading after three hours. I don't trade the afternoon session unless we get a small pullback and I'm able to enter at a good price level.

Stay long and know that you might have to weather an ugly day. I am not holding any overnight positions and a dip will be my opportunity to enter a few bullish swing trades.

.

.

Daily Bulletin Continues...