MSFT Beats On the Top and Bottom – Market Will Grind Higher Through July

Posted 9: 30 AM ET - Yesterday the market probed for support and the damage was contained. There is very little profit-taking and the bid is strong. That could have been our "ugly day" and the selling pressure never gained traction. I believe the market will grind higher the rest of the week.

Earnings season is just getting started. Microsoft beat on the top and bottom in Q2 and that will set a positive tone for tech stocks. As I mentioned in my comments Tuesday I expected a good number. Intel posts after the close and the numbers should be good (but not as good as Microsoft).

We are in the summer doldrums. Trading volumes are extremely light and a small bid can push stocks higher. Many Asset Managers are under allocated and they are playing catch-up. This will keep the dips brief and shallow.

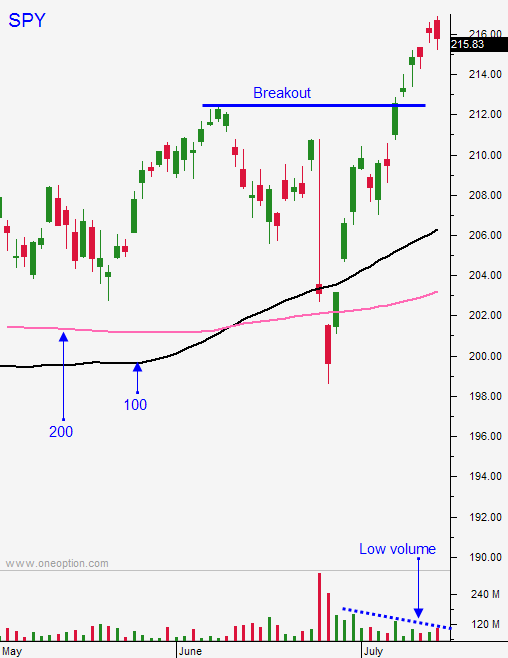

Traders are not going to stand in front of this freight train. The market is breaking out to a new all-time high and credit concerns are low. Mega cap tech stocks are about to post earnings and that will also keep shorts at bay.

Next week Google, Amazon, Facebook, and Apple will announce earnings. The FOMC will release a dovish statement and the market will make its final thrust higher.

Earnings will be underwhelming the rest of the way and credit concerns will start to surface in August. Some traders will fret that a September rate hike is likely and the selling pressure will build.

We still have a couple of weeks of decent price action. Try to maintain some overnight long positions and take partial profits along the way. It's important to set targets.

Day trading has been challenging. The market makes an opening move and it stalls. Stocks that looked great early in the day off and retreat. I have been trying to nail 4-5 good trades each day. This is about quality, not quantity. Be patient and wait for the set up. I have been able to make decent money in this market day trading. It is critically important to avoid bad trades. One mistake could strip all of your profits away.

I like buying stocks that have recently pulled back and that have formed a base. When the stock breaks through horizontal resistance on decent volume I know I have a good candidate. These stocks have plenty of upside and they don't necessarily need a market tailwind to move higher.

I have not been trading the afternoon session. I will only do that if the market dips during the day. If I can reload my longs at a good price I know I can make $.30-$.40 on a late day rally. We haven't seen many of these dips and I have mainly been trading the first few hours of the day.

Earnings season will provide some action. We will have plenty of great day trades for the next few weeks.

Keep some overnight longs and manage profits. Set targets and gradually scale out of your winners. Day traders need to be extremely selective.

Look for a grind higher the rest of the week.

.

.

Daily Bulletin Continues...