Bullish Week Ahead – Gradually Take Profits – Know That An Ugly Day Is Looming

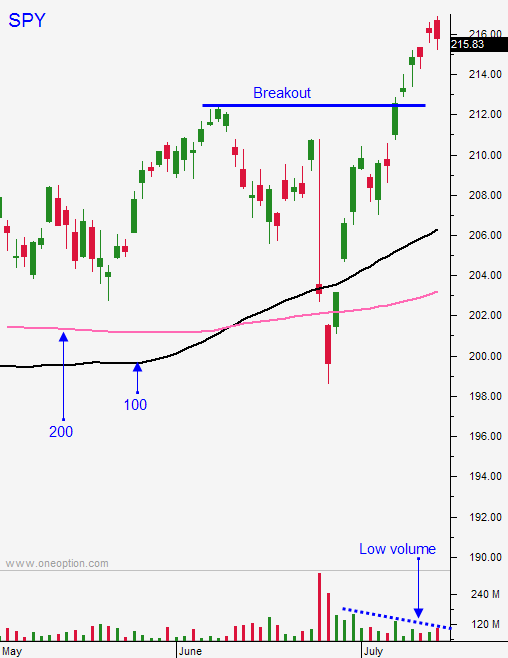

Posted 9:30 AM ET - The market has been able to inch higher on light volume. No one wants to stand in front of this freight train when the S&P 500 is making a new all-time high. This is especially true when mega cap tech earnings are on deck. Many Asset Managers are under allocated and they are playing catch-up. Even a small bid in this environment can push stocks higher.

The failed coup in Turkey and Softbank's takeover of Arm Holdings has sparked a little buying this morning.

Earnings will crank up this week and the action should improve. The GOP Convention might add a little spice. The only economic releases worth mention are the flash PMI's on Friday.

Next week the Democratic Convention and the FOMC meeting will keep the market moving. Earnings season will be in full bloom and there should be a decent pace to the action.

I am expecting a gradual move higher this week. Now that the market has closed above the breakout for more than a week, I am starting to embrace the move. I will not chase stocks at this level. We are likely to see a nice one day decline and I will wait for that opportunity. When I do take some overnight longs, I will not go gangbusters. I feel that earnings season will be okay, but not great.

We have about 2 to 3 weeks of decent price action left. In August we should see some profit-taking.

I have primarily been day trading and I've had a spattering of overnight call positions. The majority of my activity is intraday.

The market tends to make big moves on the open and then it stalls. I've had to wait an hour and sometimes much longer before I see an opportunity set up. I like to see the low of the day challenged and once support is established there is a nice little day trading window. Make no mistake; this has been a relatively tough trading environment. Patience is the key to making money.

I prefer to buy stocks that have formed a base after retracing. When they rally off of the base and they break through horizontal resistance on good volume, an opportunity presents itself. These stocks do not need a market tailwind to move higher and that is why I prefer them.

If you are buying stocks that are making a new 52-week high, know that you need steady price improvement from the market. At the first sign of trouble, the bid in these stocks often crumbles.

.

.

Daily Bulletin Continues...