Market Trapped – Trade the First 2 Hours and Go Golfing – Don’t Force Trades

Posted 9:30 AM ET - Trading volumes are down 60% and we are in a news vacuum. Trim your size and keep your trade count down. The market is wound very tightly and it could stay that way for a couple more weeks.

I am day trading the first 2 hours and then I am enjoying some time off. All I need is one or two good trades.

On the open I am shying away from stocks that are breaking out to a new 52-week high. They need help from the market to march higher and they won't have that tailwind. Often these stocks rollover as soon as the momentum stalls. After an hour I might try them if I see relative strength or if they pullback and compress.

I prefer to buy stocks that are breaking through horizontal resistance and that are trading near the low end of the three-month range. DDD is a good example. These stocks have good upside potential and they often do not need help from the market. Make sure they have relative strength. I also like these stocks because I have the latitude to hold them overnight if needed. I like these long-term breakouts off of a base and I'm less concerned with the downside risk.

I don't have the latitude to hold stocks overnight when they are making a new 52-week high. If the market sells off overnight these stocks will pull back sharply and I don't want to take that exposure.

I'm also keeping an eye on shorts. There are some good ones each day and if the number increases I will know that the market is starting to weaken. It is always good to monitor both sides.

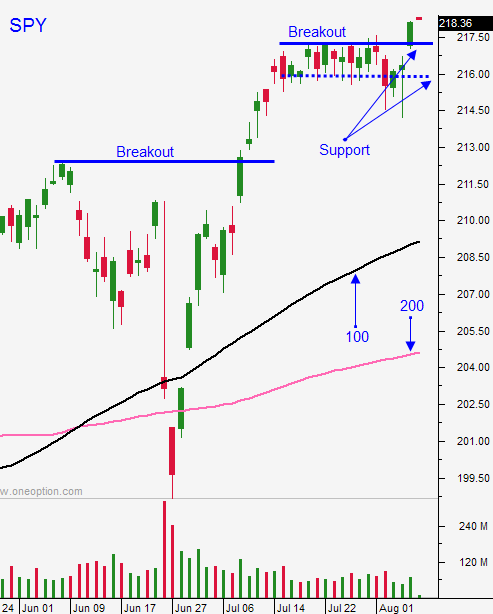

The SPY broke through resistance at $217.50 and that is now a support level. As long as we are above it I will trade from the long side. If we fall below it, I will focus more on the short side.

Daily trading ranges are extremely tight and there is no momentum. This is a great time to enjoy the summer and to take a break. If you “stick it out” you are likely to enter marginal trades and lose money.

There really isn't much news to drive the market this week and you can expect very boring trading.

As the month unfolds, look for signs of profit-taking. Late day selling on a consistent basis would be bearish.

.

.

Daily Bulletin Continues...