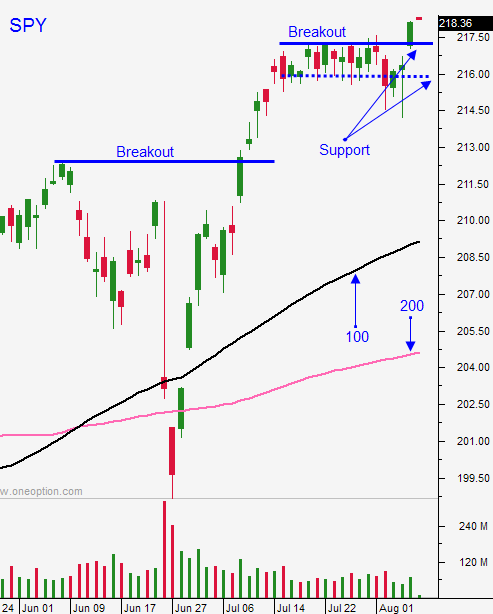

Lean On the Breakout At SPY $217.50 – Reduce Your Trade Count and Trim Your Size

Posted 9:30 AM ET - Last week trading volumes were as low as we've seen all year. A solid round of earnings and a slew of economic releases did not stimulate activity. Friday's jobs report was better than expected (255,000) and the news was well-received. The SPY rallied through resistance at $217.50 and it was able to hold that level.

The news was very light over the weekend and we will start the week with a flat open.

As long as the SPY is above $217.50 I will trade from the long side. It is getting harder to make money buying stocks intraday and patience is critical. We will not have a market tailwind to lean on so we need to make sure that we are buying stocks with excellent relative strength. I will be buying dips this week and I will not be chasing breakouts.

Stocks that are making a new high tend to gradually tick higher and it takes forever to make $.30. Soon as the momentum stalls, they drop $.20 or more and profits vanish quickly. You need to set passive targets this week. If you find yourself in a stock that goes parabolic on a five-minute chart, sell into strength. Don't wait for the stock to roll over.

Last week we found excellent stocks each day. In fact, many stocks trended throughout the day and that is pretty unusual in a flat market. Biotech and small cap stocks were strong.

I am spending more time looking at the short side. In particular I like stocks that have rallied to resistance and that have not been able to advance with the market. Ideally they are in tight compressions. When horizontal support fails these stocks quickly roll over.

Reduce your trade count this week and trim your size. We are in the summer doldrums and we are also in a news vacuum.

August and September are historically weak months. I expect to see some profit-taking in the next couple of weeks.

The market is coiled very tightly and it could go either way. Consequently, I don't like buying options. Time decay is also an issue. Option implied volatilities are near historic lows and I don't like selling credit spreads either. You have to go too close to the money to get any kind of premium and one little market sniffle could spell trouble. There are times not to trade options and this is one of them.

Look for very quiet trading this week. The breakout last Friday seems vulnerable and I would not be surprised to see it fail in the next couple of days. Some traders will worry that the "hot" jobs number will increase the chances for a rate hike this year. If we drift back into the trading range we will chop around until the end of the month.

Day trading is still the best strategy and it will require a little more diligence. I will trade the first couple of hours each day, but I don't plan on trading the afternoon sessions.

Use $217.50 as your guide and try to make your money early. Buy dips and focus on stocks with relative strength.

.

.

Daily Bulletin Continues...