Reduce Your Trade Count – Trim Your Size – Set Passive Targets – Only Trade the Open

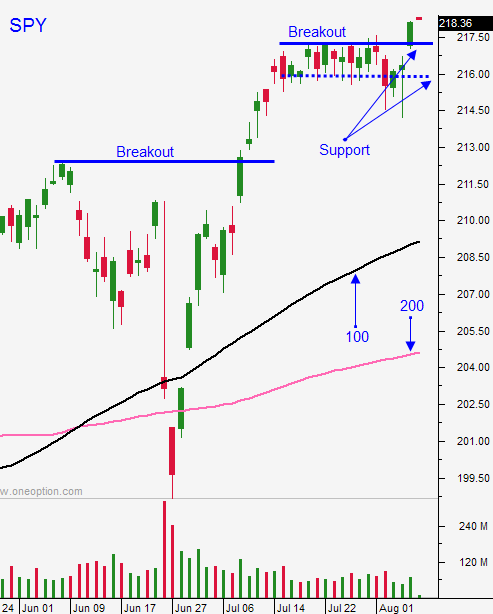

Posted 9:30 AM ET - The market is trapped in a tight trading range and the activity is terrible. The trading volume on the S&P 500 is down over 50% from normal levels.

We can expect this to continue for another week or two. The news is light and we are lucky if we get a couple of hours of movement.

Yesterday I nailed a nice $3.00 winner (NVRO) and a $1.10 winner (YY). My trade count is low and this is as good as I can expect.

We been able to find a handful of decent trades each day in the chat room and we are done by mid-morning. If you can consistently make money in this market environment, you can make money in any environment.

I'm not taking any overnight positions. The market is wound tightly and one of these nights we are going to get a move. Stocks that are up today are down tomorrow and it does not make sense to take overnights.

Trim your size, reduce your trade count, set passive targets and conclude your trading a few hours after the open.

These are the summer doldrums.

.

.

Daily Bulletin Continues...