Market Trapped…. Day Trade – Anatomy Of A Good Trade – Video

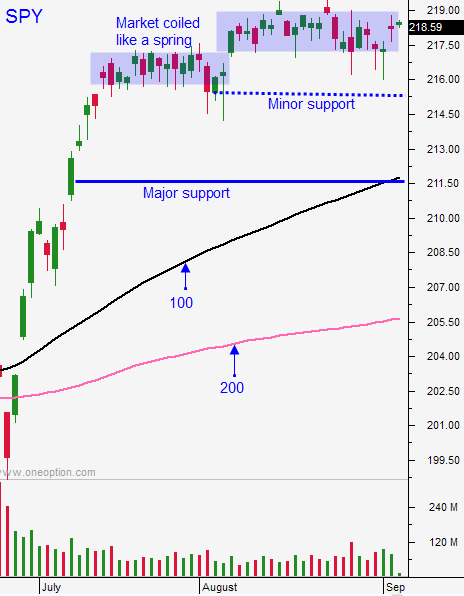

Posted 9:30 AM ET - We are in a holding pattern until the market breaks out two new high or until support at SPY $215.50 fails. It is senseless to try and predict which way this will be resolved. Once we have technical confirmation we can swing trade.

Day trading is starting to improve. The volume is gradually coming back and stocks that are moving have a nice orderly pace. In August that was not the case. Stocks would often tick higher and then randomly shed the gains.

I am using a contrarian approach to my day trading. My chat room members constantly hear me preach….. market first, market first, market first. The S&P 500 is trapped in a tight range and once an intraday move stalls, it is likely to reverse. Stocks sold off early yesterday and once support was established I started to look for relative strength. We bought stocks that were moving higher against the market and they popped when the S&P 500 rallied.

There is a specific pattern that we trade. There are four key elements to a good swing trade and when they are present we know we have an excellent day trading opportunity. We drill down to a five-minute chart and we evaluate relative strength. When a stock that is strong relative to the market compresses, we wait for a breakout and then we buy it. Watch this short video and I will show you.

Our success rate is north of 80% and our winners are huge relative to our losers. It's hard to abandon this strategy when it's working well so I'm not overly anxious to swing trade. I also like the constant cash flow and I sleep well knowing that I don't have any overnight risk.

Until the market breaks out…. day trade. The next news event is the FOMC meeting on September 21st.

This is a weak seasonal stretch for stocks, but I don't see any signs of selling pressure.

Swing traders be patient and wait for technical confirmation.

.

.

Daily Bulletin Continues...