Best Day Trade Will Come On the Bounce – What Happens Next Is Important

Posted 9:40 AM ET - We are finally getting some movement this morning. The S&P 500 is down 15 points pre-open. I didn't even have to look at the newswires to figure out why. Stocks are addicted to easy money and the ECB failed to whisper sweet nothings in the market's ear yesterday. There were also some hawkish comments from a Fed official.

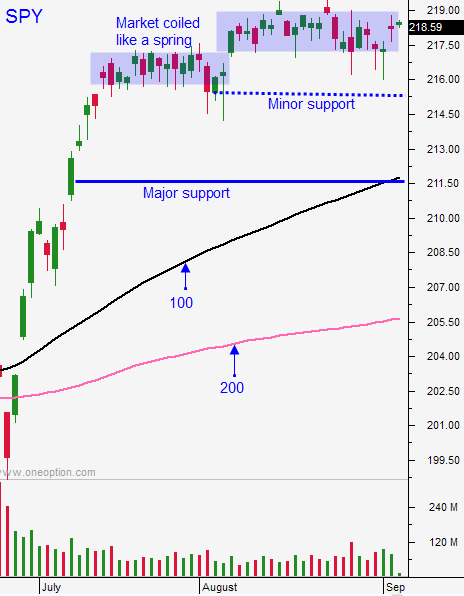

Minor support at SPY $217.50 will be breached. I am much more interested in the $215.50 level.

I'm not going to read too much into the decline this morning. Weak hands will be flushed out.

September is a seasonally weak period and we should expect some profit-taking. Trump is catching up in the polls and this adds a little uncertainty. No one knows the impact of his policies.

The soft jobs report will keep the Fed sidelined when it meets on September 21st. Consequently, I believe the decline today will be relatively short-lived. We could possibly challenge the 100-day MA in the next few days, but I don't think we will spend much time there.

Once I see the price action I will know. A new low after two hours of trading would result in an air pocket this afternoon. Traders will reduce risk heading into the weekend and we could close on the low.

The best move of the day will come once the market finds support. I will be looking for relative strength and when the S&P stops going down I will start buying these stocks. As long as the market keeps rebounding, I will stay long. As soon as the bounce stalls, I will take profits. After this move I will carefully monitor the market.

The SPY will test the lows once more and I will be watching closely. If we easily take out the low I will short S&P futures. I can get in and out of the position with ease and that is why I prefer this strategy over individual stocks. If the market rebounds I will focus on individual stocks. I don't mind being long and my gut tells me that this decline will be relatively contained.

On a longer term basis once the market breaks out of this range I will start to swing trade.

My overnight risk exposure is as low as it's been all year. I only have two positions (one long and one short). I've been warning you to keep your overnight risk exposure low.

Try to play the bounce this morning and watch the price action very carefully as the market tries to test the low.

If the SPY closes below $215.50 (unlikely) I will hold a few puts over the weekend.

.

.

Daily Bulletin Continues...