FOMC Reaction Will Be Critical – This Pattern Is Likely To Repeat

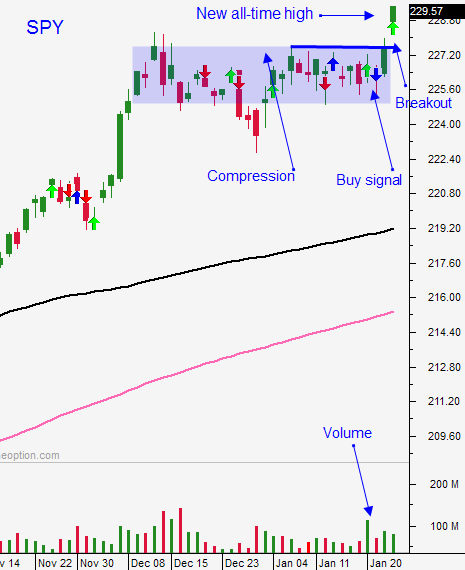

Posted 9:00 AM ET - The market sold off yesterday and most of the damage was done in the first 30 minutes of trading. Support at SPY $228 was breached and the breakout has been tested. This level needs to hold and stocks need to bounce this week for the price action to remain bullish. The FOMC statement tomorrow will set the tone.

It is normal for the market to break through horizontal resistance and to retest that breakout. The S&P 500 is down five points before the open and it will probe for support.

The Fed has raised rates two times in the last three years and it plans to hike three times this year alone. This is a very aggressive agenda and we don't know if economic growth is strong enough to shoulder these moves. Employment growth is meager, but other economic indicators have been solid.

The market has had a tendency to decline ahead of the FOMC statement and to rally afterwards. I believe the Fed's statement will be balanced and June might be targeted by analysts for the next rate hike. This result would be market friendly and we should get a nice bounce.

Earnings season will peak this week (AAPL after the close) and it is filled with important economic releases (ADP, ISM manufacturing, ISM services and the Unemployment Report). The action will be a little slow today, but the rest of the week will be brisk.

Trump has certainly stirred the kettle. Reduced business regulations and lower corporate taxes are bullish for the market, but international trade wars are not.

From a trading standpoint, we want volatility. The worst-case scenario would be another tight trading range. I don't see this happening. We will either bounce in the next few days or the market will drop below the lower end of the compression formed in the last two months.

Until we know which way we are headed, keep your powder dry.

I believe the market is headed higher and I am lining up call trades. The gap from last Wednesday has been filled and the decline yesterday was typical. When the market does bounce I will trade with even greater confidence knowing that this breakout has been tested and validated.

Swing traders, keep your powder dry and wait for the market to close above SPY $228.60

Day traders wait for market support today and look for opportunities to get long. I believe the downside will be contained and we will see an early low. The price action will slow down dramatically ahead of the FOMC statement so I not trade the afternoon session.

By the end of the week we will know exactly how to position ourselves.

.

.

Daily Bulletin Continues...