Fed Jitters – Use SPY $228.60 As Your Guide This Week – Buy Dips

Posted 9:00 AM ET - Last week the market made a new all-time high as Trump executed his game plan. The promise of reduced business regulation and lower corporate taxes sparked buying. Earnings season has been decent and it will climax this week. The S&P 500 is down this morning and it looks like we will fill in the gap from last Wednesday.

Trump got credit for the rally and he is also being blamed for the decline this morning. Personally, I feel the market wants to go higher, but there are nervous jitters ahead of the FOMC meeting on Wednesday.

The Fed plans to hike three times this year and that is an aggressive agenda. Traders will gauge the statement so that they can anticipate the next move (June likely). I believe the Fed's statement will be balanced. They don't know if Trump’s fiscal spending plans will be approved and their actions will be contingent on Trump's success.

Employment data points have been sluggish, but other economic indicators (ISM manufacturing, ISM services and GDP) have been good. Global growth has also been improving.

Mega cap tech stocks have posted solid results. Apple will report after the close Tuesday and Facebook will report after the close on Wednesday.

The market has had a tendency to pullback ahead of FOMC statements and rally after the news. I believe that pattern will hold true this week and any dip will represent a buying opportunity.

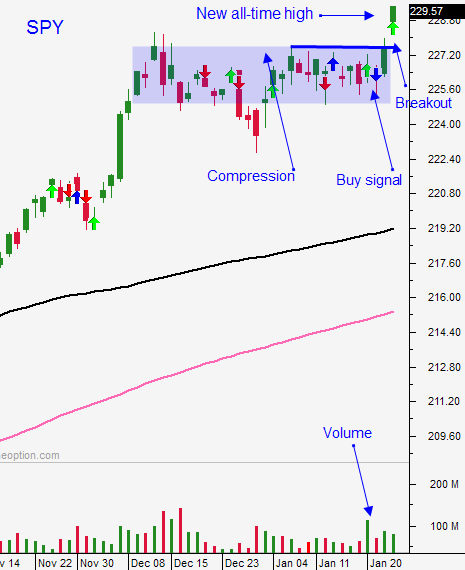

If you are long calls, use a close below SPY $228.60 as your stop. That was the open from last Wednesday and we need to hold that level. We will poke below it this morning, and we need to finish above that level by the end of the day. If the market does not finish above $228.60, exit your call positions with the idea of getting back in once the market gets back above that level.

More significant support is at SPY $228. That was the breakout. The market could test that level, but it needs to bounce.

Day traders should lean on those support levels this morning. I will wait for signs of buying and I will trade from the long side today. Down opens have presented excellent trading opportunities and this could be an excellent day. Once the first hour low is established, I want the market to stay above it the rest of the day. If we rally above the first hour high and above $228.60 I will get more aggressive with my longs.

A gradual drift lower the entire day (unlikely) would keep me sidelined.

I do not want to short a market that just made a new all-time high when the macro backdrop is bullish.

Watch key support levels and look for opportunities to get long this week.

.

.

Daily Bulletin Continues...